A new report from Infonetics Research finds virtual application delivery controller (ADC) revenue growing fast as cloud services, hybrid cloud technology, and the shift to cloud-architected data centers create demand for virtual appliances.

“Hardware-based ADCs aren’t going away anytime soon," notes Cliff Grossner, Ph.D., directing analyst for data center and cloud at Infonetics Research. "They still provide the performance required by larger-scale deployments, and vendors are working to fold in other services such as security, application traffic monitoring, and predictive analytics.” Grossner adds, “This will keep the market for hardware-based appliances healthy even as a portion of the ADC market turns to virtual appliances.”

Related: Report discerns slowdown in data center equipment sales

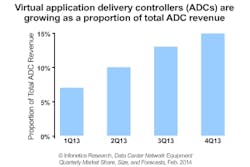

The report also finds that while WAN optimization revenue was up 4% sequentially in 4Q13, this figure remains on an overall downward trajectory, down 8% from the year-ago 4th quarter. ADC virtual appliances are going mainstream, concludes the data, accounting for 14% of ADC revenue in 4Q13; Citrix is the market share leader in this segment. While F5 continues to lead the overall ADC market, Infonetics states that "Citrix was the big winner upon Cisco’s exit from the space, gaining 5 points in market share."

The top 3 vendors in the WAN optimization space are Riverbed, Cisco, and Blue Coat, adds the report. The new data suggests that vendors are adding mobility functionality to WAN optimization products to drive new revenue while waiting for the cloud to have a positive impact.

Infonetics’ quarterly data center equipment report provides worldwide and regional market size, vendor market share, forecasts through 2018, analysis, and trends for data center network equipment including data center Ethernet switches, application delivery controllers (ADCs), WAN optimization appliances, and Ethernet switches sold in bundles. Vendors tracked include A10, Alcatel-Lucent, Arista, Array Networks, Barracuda, Blue Coat, Brocade, Cisco, Citrix, Dell, F5, HP, Huawei, IBM (BNT), Juniper, Kemp, Radware, Riverbed, and others.

See also: Survey: Most heavy data center equipment is manually lifted

About the Author

Matt Vincent

Senior Editor

Matt Vincent is a B2B technology journalist, editor and content producer with over 15 years of experience, specializing in the full range of media content production and management, as well as SEO and social media engagement best practices, for both Cabling Installation & Maintenance magazine and its website CablingInstall.com. He currently provides trade show, company, executive and field technology trend coverage for the ICT structured cabling, telecommunications networking, data center, IP physical security, and professional AV vertical market segments. Email: [email protected]