Datacom up, telecom sluggish in 2014, says analyst

A pickup in datacom spending in 2014 partially offset continuing softness in telecom revenues at the start of 2014, according to an upcoming report from Infonetics Research. The datacom market should continue to be healthy in 2015 says the market research firm (now part of IHS Inc.), in the latest edition of its semi-annual Global Telecom and Datacom Market Trends and Drivers report.

"After a weak 2013, enterprise networking and communication revenue growth accelerated in 2014 thanks to a resurging North American market and stepped-up investments in security infrastructure," says the co-author of the report, Matthias Machowinski, Infonetics' directing analyst for enterprise networks. "We expect similar results in 2015, when strong end-user demand in North America and Asia-Pac is likely to be offset by a slowdown in Europe."

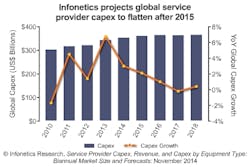

In addition to increased investments in security, key trends in the enterprise networking and communication markets include the adoption of cloud services and the use of cloud architectures in enterprise data centers, the report states. The news wasn't so good on the telecom side, notes the analyst, thanks to weakness in mobile revenues and continued economic problems in Europe. For example, global mobile service revenue for the first half of 2014 rose just 0.5% from the same period in 2013, with Europe proving a drag on growth, according to Infonetics.

"Overall, growth in telecom revenue continues to slow in every geographic region. Europe's five largest service providers -- Deutsche Telekom, Orange, Telecom Italia, Telefonica, and Vodafone -- continue to experience declining revenue, though less pronounced than in the past 3 years. And in North America, AT&T and Verizon have signaled that the mobile services price war started by T-Mobile US is taking a bite," said Stephane Teral, principal analyst for mobile infrastructure and carrier economics at the market research firm.

Infonetics expects moderate global economic growth of 3% for 2014, thanks to Europe as well as what it called "a significant slowdown" in Brazil and Russia. However, there were pockets of progress. Mobile data services (text messaging and mobile broadband) rose in every region in the first half of 2014, thanks to the increasing use of smartphones. Along these lines, mobile broadband services grew 26% year-over-year, enough to offset the decline of SMS revenue, Infonetics says.

The twice-annual Global Telecom and Datacom Market Trends and Drivers report provides analysis of global and regional market trends and conditions affecting service providers, enterprises, subscribers, and the global economy. The report assesses the current and expected future state of the telecom industry, including spending trends, subscriber forecasts, macroeconomic drivers, and key economic statistics (e.g., unemployment, OECD indicators, GDP growth).