Electronic security systems market experiencing worldwide growth

A recent study says the industry grew throughout the recession and will continue doing so at least through 2015.

By Jeremy Towler, BSRIA

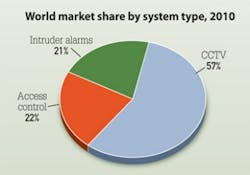

Recently BSRIA published a study of the world electronic security market. The report is broken down into 18 key countries and regions, covering established as well as important emerging markets such as the “BRIC” countries of Brazil, Russia, India and China. The report was compiled through findings from interviews with contacts throughout the world. It reveals that the world electronic security systems market is now worth more than US$58 billion, has continued to grow on aggregate throughout the recession, and is forecast to achieve double-digit compound annual growth in the period up to 2015. Few other building technology markets exhibit such attractive statistics. This article will provide detail on some of the technology types and geographic regions examined in the study.

CCTV/video surveillance

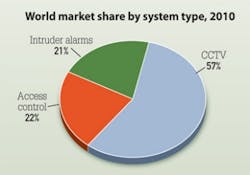

Closed-circuit television (CCTV) has the largest market share in world security, the largest markets being Asia and America. China represents 16 percent of the total world CCTV market, and North America has a share of 23 percent. This contrasts with the U.K., which despite being one of the most developed markets for CCTV, accounts for only 4 percent of the world market.

The U.K. security market is considerably more mature than many other international markets, and many of the world’s leading players are present there. Nevertheless, like the international market, it remains highly fragmented and is host to many small, local companies. The BSRIA report shows the market for CCTV, access control and intruder alarms in the U.K. was worth more than US$3.2 billion in 2010.

The U.K. is the most surveyed country in Europe with an estimated 4.25 million CCTV cameras deployed. Despite this fact, because of the low-quality image delivered by the majority of the installed base of cameras, only one crime is solved for every 1,000 cameras. This is driving demand for technological improvement of all aspects of the systems. The industry has moved toward digital and networked systems, megapixel cameras and is currently addressing issues related to digital video evidence and common communication protocols between different manufacturers’ products.

Wide-ranging application of CCTV extends from simple scene monitoring to facial-recognition technology, remote video monitoring, video smoke detection, mobile systems and automatic number-plate recognition. There is a growing trend for video analytic software, which can be programmed to intelligently analyze and respond to a changing scene. Video-analytic software is also being used to improve retail operations, such as queue monitoring, people counting and measuring traffic patterns to drive sales and customer satisfaction. Motorized pan/tilt/zoom (PTZ) cameras can detect and track intruders and new, high-definition technology is also expected to accelerate in the next few years.

The use of 360-degree panoramic cameras as well as thermal infrared cameras, based on heat-sensitive sensors that can operate in complete darkness, are both expected to grow very strongly over the next few years.

In the area of video recording, there is a growing trend away from basic digital video recorders (DVRs) toward network video recorders (NVRs) and hybrid DVRs that can accept signals from both traditional analog cameras and the latest digital cameras.

IP network-based systems continue to gain share as they offer enhanced flexibility and versatility, but also remote viewing and control of video data from one or more interfaces in different locations. They represent a lower total cost of ownership than a corresponding analog system, particularly as the system size grows.

North American market

The largest providers of software in the North American market are Schneider Electric (Pelco), ISS, Tyco, Bosch and Honeywell. Video analytics are an important part of ISS’s business, and will account for almost half of their market share. Video analytics is the fastest-growing segment in the North American security software market and the capability is widely requested. Video analytics soon will account for a third of the market, but in the meantime, video management software (VMS) accounts for the lion’s share.

There also is a strong demand for software that can more-effectively compress data in order to better handle high-volume data flow of IP cameras and systems. Although the analytics are mainly implemented in the management software or video recorder, they can also be integrated into the camera.

North America is one of the most competitive markets in the world, with many regional players and a few large multinational companies. There is strong Asian (Korean, Chinese) low-price competition entering the lower- to mid-end of the market. The market is slowly recovering from the aftermath of the global financial crisis, and showing signs of recovery.

The systems and maintenance markets are forecast to grow more strongly than the product market due to upgrades and the demand for more sophisticated solutions in general. Consequently, although we are only forecasting single-digit annual growth for product, both value-add and service-and-maintenance are forecast to achieve annual growth in excess of 13 percent up to 2015.

Chinese market

CCTV technology has been embraced rapidly and further developed by Chinese security entrepreneurs, such as HIK and Dahua. Chinese manufacturers now hold the intellectual property rights to a growing range of security products, and are starting to penetrate the global market. The market is awash with manufacturers, with around 450 players competing. Global suppliers like Panasonic, Tyco, Samsung, LG, Bosch and Honeywell all are present; some of the larger local players include names like Guotong Chuangan, Yaan, Tiandi Weiye, Shenzhen Hongdi, Infinova, Bell, Zhuhai Stone, Changzhou Mingjing, Zhejiang Dahua, HIK, Jingyang, CSST, TCL and H3C. System integrators are now providing not only design and installation services, but also many after-sales services such as training for clients on how to maintain the product and tutorials on how to use the software. These services are proving quite profitable for them.

The Chinese market is one of the biggest for analog cameras, with total sales value of US $1.113 billion in 2010, representing 38 percent of the total product market. The IP camera market is half that of analog, amounting to US $542 million. DVR and NVR also have sound performance in China; the combined market equals US $728 million, accounting for 22 percent of the total product market. In China, all of the interviewed manufacturers claimed that moving toward network cameras (and therefore adopting more NVRs) is no doubt the future product trend. It inevitably will happen, and end-users will benefit from the higher quality of images.

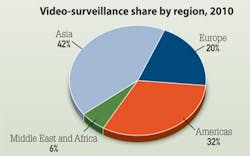

The BSRIA study has analyzed the routes to market and vertical markets in each of the 18 countries and regions, which has highlighted some interesting differences. For example, in the Middle East, 50 percent of the product is sold through distributors, whereas in Asia/Pacific, 56 percent is sold via the specialist security installers/value-added resellers (VARs).

Access control

The largest markets for access controls are Japan, with the market estimated to be worth US $1.26 billion in 2010, and North America, at US $3.05 billion in 2010—up 7 percent from the previous year and with 2011’s growth anticipated at 8 percent. Within Europe, the U.K. represents the largest market for access control at US $820 million.

The use of smart cards is increasing in offices, education and health sectors. Present examples include cashless vending, personal computer access, library systems, transport payment systems, authorizing equipment use, biometric integration, printing/photocopying privileges, intelligent time and attendance analysis. In sports facilities and auditoriums there is growing interest in integrating security with building management systems including HVAC, lift management, lighting and others to reduce energy costs. In education, key cards are deployed to allow access to specific areas for selected periods only, with the doors locking at prespecified times.

Biometric readers appear to have a promising future, but despite having been available for several years, they still only have a small penetration in the market due to price and questionable reliability. Various technologies are available, but fingerprint scanners are by far the most popular choice.

Intruder alarms

Several mature Western European markets have stagnated and begun to shrink, but younger markets elsewhere in the world are still becoming established, so overall the intruder market is still producing growth. This is well-documented by the Brazilian market. Driven by a developing market and major sporting events such as the 2014 World Cup and 2016 Olympics, growth in the Brazilian intruder market will remain above 4 percent during 2011-2015. However, this is overshadowed by the Brazilian CCTV and access control markets, each of which are expected to grow in excess of 18 percent annually.

The market for intruder alarm products in the U.K. continues to lose share of the total security market as more clients turn to CCTV-based solutions that deliver much of the same functionality as well as the visual evidence of crime incidents. Technological trends include the incorporation of multiple communications technologies and the use of dual sensors that combine more than one detecting technology. Intruder alarm remains a large market, and supports a substantial remote-monitoring business, which is not likely to disappear anytime soon.

The penetration of wireless-connected security products remains low. They are still considered to be insufficiently reliable due to latency in data transfer. In addition, they do not always fulfill data-protection requirements. Currently wireless systems are generally limited to the residential sector and small offices where installation work needs to be avoided.

Integration and convergence

Integration is the adding of value by linking different building-service applications, typically with bidirectional data exchange. Convergence is the bringing together of autonomous systems onto a common communication platform within the business enterprise to create a single unified solution.

There are an increasing number of reasons for integrating security applications. For example, with access control, CCTV can record images of people entering an area when their card is presented; the intercom system can be activated to instruct cameras to record a vehicle at an entrance; automatic number plate recognition (ANPR) can automatically open barriers to authorized vehicles. CCTV can be integrated with intruder alarms that activate “out-of-hours” settings, and cameras can be set to a higher resolution when intruder alarms trigger. Cameras even can send live footage or video clips to a mobile device. Some systems integrate all three security systems to make intelligent combined use of CCTV, access control and intruder alarms.

HVAC and lighting systems can be activated only when a person assigned to that area enters the building; the systems can be turned off when areas are unoccupied for established periods of time. Cameras with video analytics can count people and ramp up the HVAC based on occupancy. For lighting, occupancy can be verified before lights are turned on or off. Although fire systems are very much governed by regulations, fire alarms can be verified by transmitting video from the area where the smoke detector is in alarm, to verify whether or not there is an actual fire and if so, its severity. Fire-escape doors can be automatically controlled; occupants can be alerted to the precise location of the fire on graphical floor plans and via voice alarms, and power can be isolated from vulnerable equipment such as server rooms to reduce the impact of damage from sprinkler systems.

Access control systems can automatically generate a roll call based on who is in the building. Access to meeting rooms can be contingent upon confirmed bookings in calendar systems. Access control can also be used in conjunction with cashless vending, copying credits, computer log-on authentication and time-and-attendance management.

Integration offers the opportunity for many benefits, including reduction of false alarms, increased control, lower maintenance costs, reduced overhead, energy savings, increased productivity and return on investment.

Forecasting the market

The perceived security threat ranging from crime, terrorist activity and internal fraud persists. There is also a need to manage and verify processes for regulation and insurance purposes. Governments are implementing greater border security and there is increasing demand for the protection of critical infrastructure sites such as utility installations, government facilities, pipelines and transport hubs.

Continuous urbanization, expansion of public transport networks and highly publicized security incidents are driving security spending in many facilities.

Compared to the building automation industry, the security industry has been slow to implement standards; but this concept is beginning to gain momentum with the establishment of initiatives such as ONVIF and PSIA, which are rapidly gaining traction.

Distributors and value-added resellers account for more than three quarters of the manufacturers’ product sales, and this proportion will be maintained. Due to technological innovation and integration of systems, the demand by system integrators for skilled labor will continue to grow.

There remains a high degree of alliance and acquisition activity, which is expected to continue for several years as the market consolidates.

Security has become an intrinsic part of our everyday lives, and we can expect it to become even more present and ever-more discrete both inside and outside our buildings.

Jeremy Towler is principal consultant with BSRIA www.bsria.co.uk. This article is excerpted from material BSRIA made available to the public summarizing the findings of its World Security Study released in 2011.

Past CIM Articles