All-fiber networks expected in the local loop by 2015

Home and small-business digital data services will require all-fiber networks in the local loop within 20 years.

Lawrence K. Vanston and Ray L. Hodges, Technology Futures Inc.

A series of formal technology investigations with major North American local exchange carriers indicates that essentially all-optical-fiber telecommunications networks will be installed in the local loop by the year 2015.

High-bandwidth digital services for personal computers in homes and small businesses will prove the most important driver in pushing fiber closer to the end-user. Forecasts suggest that 1%--or slightly more than one million U.S. households--will be using digital data services by year-end 1998. Based on detailed analyses, this percentage is expected to grow to 25% by year-end 2005. As the number of home users increases, so will bandwidth needs. Assuming a new generation of data rates every four years, data rates should reach 45 megabits per second, or faster, by 2015--at which point the local loop must be essentially all fiber.

Small businesses are anticipated to begin migrating to 45-Mbit/sec data rates by year-end 2000. The timing of fiber- optic cable deployment to handle those rates depends greatly on the telecommunications industry`s use of various digital subscriber line technologies. However, the transition to optical fiber will occur more rapidly for small businesses than for the home market, because both the topology and the demands of business customers favor fiber solutions more than do those of home users. Data rates of 45 Mbits/sec and higher should dominate small-business digital services after 2005.

The term "fiber-in-the-loop" (fitl) refers here to any technology that extends fiber deeper into the distribution part of the local loop--for example, within 1000 feet of the customer. The final link to the customer can be either copper wire, coaxial cable, radio transmission, or optical fiber. Although the composition of the final link is important, here we will attempt to provide an understanding of the timing of the major infrastructure changes required in future telecommunications and cable-TV networks. From this perspective, fitl includes some versions of all of the major fiber distribution architectures, including fiber-to-the-home, fiber-to-the-curb, hybrid fiber/coaxial cable, and switched digital video.

Cable-TV services aside, the most important driver for fitl is the need for high-bandwidth digital services for personal computers (or television-based versions of computers), with Internet access being the most important application. If the number of Internet users and their demands for higher bandwidth were static, then there might never be a need for fitl, given the impressive data rates offered by digital subscriber loop and cable modem technologies. However, reasonable forecasts of likely growth in Internet usage and bandwidth requirements lead to the conclusion that, as important as they presently are, copper-based technologies will completely run out of effective communications bandwidth by 2015, except for, perhaps, a very short final link.

Subscriber bandwidth needs

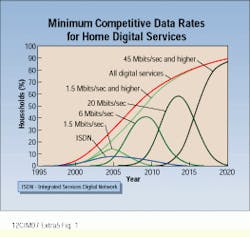

Although few homes in the United States are subscribers to digital services today, the number of these users is expected to increase rapidly as Integrated Services Digital Network (isdn), digital subscriber line, and cable modem technologies reach the mass market.

isdn is predicted to dominate digital services in the local loop market by 2001, but after that, higher-speed technologies will rule. Slightly more than one million U.S. households, or 1%, are projected to be using digital services by year-end 1998. Furthermore, assuming typical consumer electronics diffusion patterns, more than 5% of all U.S. households will be using digital services by year-end 2000, and 25% by year-end 2005.

Of the currently envisioned services that operate above isdn`s 64- and 128-kilobit-per-second data rates, the 1.5-Mbit/sec rate represents a technological threshold from the perspective of the required high-speed telecommunications infrastructure. Although cable modems will offer higher data rates, as will other versions of digital subscriber line technology, the 1.5-Mbit/sec data rate also approximates the maximum useful data rate for residential multimedia applications for the next several years.

The reason is not because of limitations in users` multimedia computers or in application requirements. Rather, the computer capacity of the Internet and of online service providers, as well as the capacity of the Internet backbone, imposes a practical limit. Setting marketing considerations aside, the 1.5-Mbit/sec rate would even be competitive today.

These limitations are envisioned to ease as network service providers continue to upgrade their computers and as capacity and speed are added to the Internet backbone network. The rate of performance increase is anticipated to be typical of the computer industry--namely, doubling bandwidth about every two years. In turn, the minimum competitive data rate for access providers should quadruple about every four years.

Consequently, four nominal rates are expected to dominate the local loop: 1.5 Mbits/sec, 6 Mbits/sec, 24 Mbits/sec, and 45 Mbits/sec and faster. The 45-Mbit/sec rate category includes a group of rates: the ultimate digital subscriber line rate of 52 Mbits/sec, 100-Mbit/sec Ethernet, 52-Mbit/sec Synchronous Optical Network (sonet) OC-1, and 155-Mbit/sec sonet OC-3. Using the four-year quadrupling progression rule, the target rate for the highest-speed category becomes 100 Mbits/sec. This progression might translate directly to access speed for telecommunications companies, especially those companies deploying digital subscriber line technology, because the rates correspond roughly to the major categories of digital subscriber line equipment.

The introduction and adoption of these data rates are evaluated separately, even though from the perspective of usefulness (as opposed to the perspective of carrier technology) the process is continuous. A total life cycle of 10 years is estimated for each data rate, which is typical for computer equipment and telecommunications circuit electronics. During this cycle, the 1.5-Mbit/sec rate will dominate the local loop network until about the year 2005, then 6 Mbits/sec will dominate until about 2010, 24 Mbits/sec until 2015, and lastly, 45 Mbits/sec after 2015.

Until the 45-Mbit/sec rate requirement is reached, the projected rates can be provided by copper-intensive digital subscriber line or cable modem technology, which relies on coaxial cable. However, as bandwidth increases toward 45 Mbits/sec, so does the demand for optical fiber deeper into the network. By 2015, when the 45-Mbit/sec rate will dominate, the local loop must essentially be an all-optical-fiber network, even if digital subscriber line or cable modem technology is also employed.

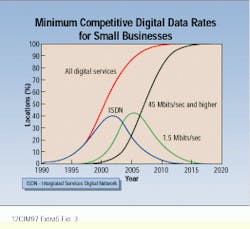

Small-business market

isdn has been the main communications technology available to small-business locations, and adoption has been rapid in recent years, with 760,000 lines in service by the end of 1996. With 6.5 million small-business locations, this distribution means customer penetration has surpassed 10%. For the next several years, digital services will be delivered primarily at isdn rates, with faster services becoming prevalent after that time.

As with home services, a small-business migration to higher-speed services is anticipated, but in a different progression pattern. Specifically, the migration is estimated to duplicate that experienced by larger businesses--first to 1.5-Mbit/sec services and then jumping directly to the 45-Mbit/sec rate category, which includes 52-Mbit/sec digital subscriber lines, Ethernet, OC-1, and OC-3.

One percent of all small businesses are forecast to be using 1.5-Mbit/sec services by year-end 1998 and 45-Mbit/sec services by year-end 2000. After 2005, the 45-Mbit/sec or faster rates should dominate the delivery of small-business digital data services. q

Lawrence K. Vanston is president of Technology Futures Inc. (Austin, TX), and Ray L. Hodges is senior consultant at the company`s Tampa, FL, branch.

This article is excerpted from the May 1997 issue of Lightwave magazine, another PennWell publication.

The number of home subscribers for digital data services is expected to increase rapidly as Integrated Services Digital Network, digital subscriber line, and cable modem technologies reach the mass telecommunications market. Based on a series of telecommunications technology forecasts, 1% of all U.S. households are expected to receive digital data services by year-end 1998, 5% by year-end 2000, and 25% by year-end 2005. Telecommunications service speeds are estimated to approximately quadruple every four years.

Presently, more than 6.5 million small businesses in the United States are receiving Integrated Services Digital Network services. By the year 2000, at least 50% of small busi-nesses are expected to be using digital services; by the year 2005, small-business users are projected to approach 90%. The migration to higher-speed digital services is foreseen as moving to 1.5-Mbit/sec data rates first and then jumping directly to 45-Mbit/sec rates.