The global cabling-systems marketplace, after being in decline for the past two years, is expected to modestly renew its growth this year.

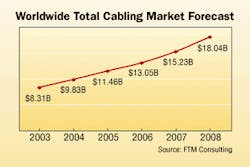

As a result of the global economic downturn, in conjunction with market saturation in mature geographical markets such as the United States, the worldwide cabling-systems market decreased by 18.5% in 2001 and by 10.5% in 2002. Positive growth is expected to return this year, but at a modest growth rate of only 6%. This small growth is caused by the expected continuation of the economic slowdown in the first half of this year, in conjunction with a slow recovery projected for the second half of the year.

Double-digit growth

The worldwide cabling market is projected to grow from $8.3 billion in 2003 at a growth rate of 16.8% per year to $18 billion by 2008. There are two primary reasons:

- In the mature geographical markets, new broadband applications are expected to emerge that will require upgrading of existing copper cabling with new-technology fiber cabling;

- Less-mature markets (such as China), because they are still relatively unpenetrated, will need to install their initial LAN cabling with inexpensive copper cabling.

An additional factor will be the emerging countries (India, for example) that will skip copper cabling for their initial networks and deploy more expensive fiber cabling in their leading-edge industries, such as education and software development. These countries, which are not burdened with legacy copper cabling, can bypass the older technologies and go directly to fiber cabling.

null

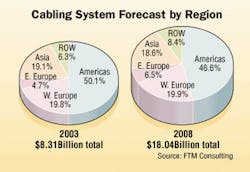

Because of the United States' leadership position in early establishment of LAN cabling, the Americas will remain the largest of the world's five regions throughout the forecast period. In 2003, the Americas region accounts for 50.2% of the total worldwide cabling market—a clearly dominant position. By 2008, the Americas region is expected to retain its leading position, but at a smaller share of 46.6%.

null

The major trend will be the increase in market share by currently undeveloped regions, which are expected to take share from the developed regions. The Eastern European region, and the other regions of the world that consist of many undeveloped countries with limited cabling penetration, are expected to increase their shares. Eastern Europe is projected to increase its share from 4.7% this year to 8.4% by 2008. The "rest of the world" (ROW) region, as it is described in the study, is also expected to increase its share from 6.3% in 2003 to 8.4% by 2008. Two regions—the Americas and Asia/Pacific—are expected to lose share, while the Western Europe region will retain its share.

This trend relates to market saturation in the regions that are projected to lose market share, while those that are increasing their share are relatively unpenetrated and will install their initial LANs over the forecast period.

Frank Murawski is president of FTM Consulting. This article summarizes findings of FTM's most recent study, Worldwide Fiber and Copper Building Cabling Systems.