The datacomm building cabling market is expected to revive during the next five years, and the market renewal will open up new doors for optical-fiber cabling.

FTM Consulting, Inc.'s (Hummelstown, PA; www.ftmconsultinginc.com) recent research report, Fiber Cabling Systems: U.S. Building Market, points to a market change and the important role optical fiber will play in it.

The report predicts optical-fiber cabling growth in the 20-plus percent range. Much of the demand will come from pent-up demand for higher speeds requiring fiber cabling systems at critical network points, such as Storage Area Networks (SANs).

"The growth has to do with user demand requirements, and this bottleneck release," says Frank Murawski, president of FTM Consulting. "I'm running 10 Mbits/sec or 100 Mbits to the desktop, and realizing that the riser system won't support 1 Gigabit to the desktop, so I have to upgrade the riser."

This projection represents a big change for the market. Murawski notes that the economic slowdown of the past two years put a halt to expenditures for information technology systems, including networks and their associated cabling products. During the 1990s, fiber was typically used only in the riser cabling subsystem.

The FTM report indicates that the fiber cabling market had no growth in 2002, and only 2.8% growth in 2003. The optical-fiber cabling market persisted in 2003, and saw small growth due to new campus cabling needs.

This slowdown combined with the saturation of copper cabling at large enterprises—the mainstay of the marketplace. Copper cabling had grown at phenomenal rates in the 1990s as the initial LANs, using Category 5 copper cabling, were installed in the larger enterprises. By 1999, most of these large networks were already in place, leading to the onset of saturation for the cabling market.

Fiber cable growth this year is expected to be restrained at 3.4% growth. But while the copper cabling market is expected to be hampered by saturation, the emergence of new broadband applications, along with the need for that higher bandwidth at network bottlenecks, is expected to provide a stimulus for optical-fiber cabling growth after this year.

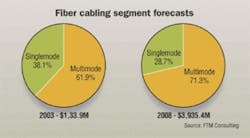

In 2005, Murawski says, a growth of 36% is projected, mostly due to the need for higher speeds at SANs and campus applications. This growth is expected to continue through 2008. As a result, the optical-fiber cabling market is expected to grow at a cumulative average growth rate of 28.3%, going from $1.1 billion in 2003 to $3.9 billion by 2008.

Two key technology developments are expected to foster the growth: increased usage of laser-optimized multimode optical-fiber cables. and use of short wavelength 850-nm VCSELs instead of more costly laser sources.

Murawski says that for the bandwidth requirements for these products to be met, "People need to put fiber in."

These developments are expected to be aided by a rebounding economy. As the economy improves, capital expenditures for networks are expected to resume. And the falling cost of optical fiber and its components will only fuel the growth, Murawski says.

"The cost is coming under control for some of these switches and routers and high-end Gigabit stuff, and people are switching over to all fiber," says Murawski. "It makes a lot of sense instead of having a hybrid."

"A lot of people are not scared of fiber anymore," adds Murawski. "They used to associate it with high cost, and there was a deterrent because the user was not familiar with it. Now, they are more and more familiar with it."