A recent study finds that the optical-fiber market is still out of balance, and more consolidation among manufacturers is required to balance supply and demand.

"The biggest thing is to reduce the capacity," says Patrick Fay, senior analyst for KMI Research (Providence, RI; wwwkmiresearch.com) in its recent report, "Worldwide Optical Fiber and Cable Markets: Market Developments and Forecast."

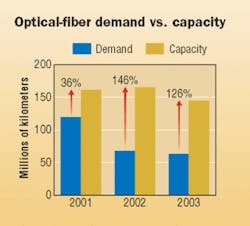

KMI says the world's last optical-fiber shortage ended in 2001 when demand peaked at 119 million kilometers. Two years later, fiber shipments to cable manufacturers dropped by 47% to 63.5 million kilometers. On the other hand, worldwide fiber-making capacity only decreased by 10% to 145 million kilometers, down from 161 million kilometers in 2001.

Fay says the problem is that companies are holding fast to their decision to produce optical fiber, and few are merging or getting out of the business altogether.

What few examples of consolidation that have occurred, says Fay, are not extensive enough to overcome the huge disparity between the market's capacity and demand. Most optical-fiber producers, he says, are engaged in a waiting game.

"Part of it is a lot of these companies have made big investments in this capacity, and hope that someone else will leave first, giving more opportunity for folks who remain," says Fay.

Fay also says that optical-fiber producers in Asia need to reduce their capacity. But given the demand in that region of the world, it is highly unlikely that will happen.

Optical fiber manufacturers are certainly making money, but their products have become increasingly commoditized and difficult to differentiate. Fay says another end result of the fiber surplus has been drastically reduced prices. During the optical-fiber boom of 2000, for example, the price of conventional singlemode fiber was around $35 per kilometer. In 2003, that price was down to about $15 a kilometer or lower.

"It's surplus fiber that drives the price down," says Fay. "If you have a number of producers who are trying to sell fiber, then to attract that bid on a contract, they have got to offer aggressive prices."

But prices can't remain this low without eventually taking a toll on manufacturers, Fay says. "At some point, people will have to decide it is not worth it anymore, and they will exit the market."

The disparity between demand and capacity

- The world's last optical-fiber shortage ended in 2001 when demand peaked at 119 million kilometers.

- In 2003, fiber shipments to cable manufacturers dropped by 47% to 63.5 million kilometers.

- Worldwide fiber-making capacity decreased by only 10% to 145 million kilometers, down from 161 million kilometers in 2001.

Source: KMI Research