Lured by market potential, many contractors are jumping on the bandwagon.

Arlyn S. Powell, Jr.

A few years ago, we polled cabling contractors about the residential market; what we found led us to title the article "Home market alive-but not a living."

For instance, Steve Vincent, a partner at Cable Systems Inc., an installation company in North Haven, CT, was quoted as saying: "If I just focused on the home business market, I'd be out of business." According to Vincent, as well as a number of other contractors interviewed at the time, the residential market, including small office/home office (SOHO), although approaching 50 million sites nationwide, was more trouble than it was worth.

Among the complaints heard most often were that the work took longer to complete, jobs paid less than commercial work, and there were often headaches with the customers. "It's a pain to work with home customers," claimed Douglas McNie, owner of Low Voltage Systems (San Leandro, CA), "mostly because they don't really understand the systems, and they're prone to changing their minds."

Another complaint was that residential retrofits are much more difficult than commercial upgrades: Wooden structures are hard to fish and run cables in; there are usually no dropped ceilings above which cable can be run; and homes often have finished basements and attics, making it difficult to locate cable runs in those areas.

A growing market, full of promise

Despite these difficulties, however, most industry analysts and market researchers agree that the residential and SOHO cabling markets have skyrocketed in the last two years, especially for new residential construction, where the retrofit problems do not exist and cabling contractors can achieve economies of scale by wiring whole developments or multitenant buildings.

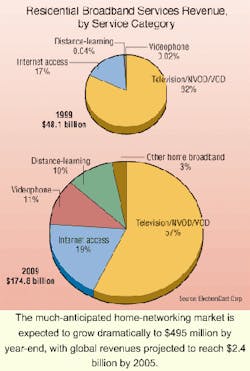

For example, Allied Business Intelligence Inc. (ABI-Oyster Bay, NY), one of the market-research firms specializing in this marketplace, predicts that the home-networking market will almost quadruple this year-from $134 million in 1999 to $495 million by year-end. ABI projects global revenues of $2.4 billion by 2005.

According to ABI's recent report, "The Broadband Home," more than three-quarters of home networking currently goes over telephone lines. Even though a standards-setting consortium, HomePNA, supports this technology, it may not be the last word, according to the report.

"Ultimately," says ABI senior analyst Navin Sabharwal, "to drive volume, home-networking solutions have to be embedded in a variety of devices. This is particularly true outside of the United States, where phone jacks are not as pervasive, and there may be more limitations on what can be run over home-telephone wiring."

Wireless and powerline technologies have, to date, been hindered by a lack of uniform standards. The HomePlug consortium, however, is addressing powerline issues, and two standards bodies-HomeRF and the Institute of Electrical and Electronics Engineers-are working on wireless standards. Many industry observers believe the IEEE's 802.11b standard will prevail in the wireless marketplace, but ABI's Sabharwal is not so sure.

"I think the heralded demise of HomeRF is premature," he says. "HomeRF still retains a cost advantage over 802.11b, and has a time-to-market advantage in the consumer market because it operates on a Windows platform."

Market researcher Cahners In-Stat Group (CISG-Scottsdale, AZ) also reports strong activity in the residential market this year. CISG, however, sees the emergence of residential-gateway technology as being key to the boom. Mike Wolf, CISG's manager of local-area-network (LAN) and enterprise services, says, "This new device class has received enormous attention from the service-provider community, as they look to add value-added services to their baseline broadband connections."

CISG cautions, however, that residential sales to date have been dominated by wireless systems, such as those offered by 3Com and Proxim, as well as Apple Computer's Airport wireless product line, based on Lucent Technologies' wireless data technology. In addition, says Wolf, "we expect that demand will take time to build, given the need for education and awareness in both the vendor and service-provider communities."

Even researchers specializing in the fiber-optic marketplace are seeing signs of growth in the residential area. For instance, ElectroniCast (San Mateo, CA) projects that revenues from residential broadband services will reach almost $175 billion in North America in 2009, while narrowband services will grow to $130 billion in that year. Video services will continue to dominate the market, although Internet-access services will claim more market share, and the videophone will cut into the market for traditional telephone services-both wired and wireless.

Use of the Internet is, of course, one of the major drivers of this growth. But there are others. Faulkner Information Services (FIS-Pennsauken, NJ), which studies the residential communications market twice a year, says that 30% of the households it contacted in its most recent survey reported at least one family member running a business from home or telecommuting, up from 24% only six months before. Today, according to FIS's TELEscope Market Study, almost one in five telephone lines is paid for by a home-operated business or an outside employer.

When you stop to think about this marketplace, two things immediately jump out at you. One is the rapidity with which the residential market seems to be ramping up, as compared to growth in commercial cabling market over the last decade. The second conclusion you would come to-and it has been commonplace among telephone companies for decades-is that the number of lines to residences is huge compared to the number going to businesses. There is, indeed, tremendous market potential here, and most of the major players in the commercial cabling industry are jumping on the bandwagon early.

Residential voice, video, and data technologies

John Pryma, Genesis Cable Systems LLC

Here are some notes on residential cabling technologies, provided by an expert in the area:

- Voice services can access the residence through the twisted-pair telephone cable drop provided by the local telephone company, via the coaxial-cable drop provided by the local cable operator, or through a wireless carrier. Since voice channels only require 3 kHz of bandwidth, almost any copper cable can handle voice service in a residence.

- Regular phone lines can only support 28 to 56 kbits/sec of data through the use of analog modems, which transmit tone signals over conventional telephone lines.

- Data can be brought into the home through specially treated phone lines providing digital-subscriber-line (DSL) service. DSL can provide a low-data-rate upstream connection for requesting information and a high-speed downstream connection of up to 7 Mbits/sec. This service is only available in selected areas and for residences within three miles of a central office.

- Cable modems can provide up to 38 Mbits/sec of data over a single 6-MHz cable channel. This technology can theoretically provide more data throughput than a DSL line, but the data throughput is shared by the number of users attached to the line segment.

- Video can be brought into the home via a rooftop antenna, a satellite dish, or over a cable connection. Most cable systems offer a hybrid fiber/coaxial-cable solution. Distribution from the headend is typically over singlemode fiber to a neighborhood node, and from there the signal is distributed over coaxial cable.

- Based on bandwidth capacity, coaxial cable is usually the winner in entering the home, since telephone cables have much less bandwidth and are not suitable for broadband video distribution. Multimode optical fiber can only support a handful of video channels, but singlemode fiber can easily transport 80 to 100 video channels. But the electro-optical conversion required for fiber is very expensive.

Here are some additional thoughts regarding bandwidth:

- Category 5 and 5E unshielded twisted-pair (UTP) copper cables have a specified bandwidth of 100 MHz for 100 meters, with up to 350 MHz for some Category 5E or enhanced cables.

- Multimode optical fiber has a bandwidth of 500 MHz/km, or 5 GHz over 100 meters. This medium works great for data, but not for analog video because of problems with mode mixing.

- Singlemode fiber has literally unlimited bandwidth, and can easily support any voice (except for ringing the phone), video, or data requirement, but the electro-optic equipment needed to support the medium is still very costly. There are also powering and servicing issues in residential applications.

- Coaxial cable has up to 2.4 GHz of bandwidth per 1,000 ft, or almost three times as much as the specified maximum bandwidth for residential (and commercial) horizontal cable run of 100 meters in the cabling standards of the Telecommunications Industry Association (TIA-Arlington, VA).

- Coaxial cable can handle voice, video, and data in both directions simultaneously. For example, a residential frequency plan for multiplexing on a coaxial system could be as follows:

- Voice channels, each using 3 kHz of bandwidth located from 0 to 5 MHz;

- Low-speed data (for example, for meter reading) from 5 to 10 MHz;

- High-speed data (such as Internet access) from 10 to 50 MHz;

- First 83 television channels from 54 to 890 MHz;

- Second 83 television channels from 900 MHz to 1.8 GHz;

- Satellite television channels from 1.8 to 2.4 GHz.

Thus, coaxial cable can not only provide all needed voice, video, and data services going into a residence, but also can be used to distribute the services within the residence. To reduce multiplexing costs, however, it probably makes sense to use the coaxial cable for surveillance and entertainment video distribution, while employing twisted-pair cables for voice and data distribution. The switching would be done at a residential gateway, which could be a cable modem or a more elaborate device.

Wireless technology may be used for some rewiring applications in existing homes. However, wireless can currently transport only 2 to 10 MHz of data and only one video channel at a time. Voice works fine over wireless, and conventional wireless or cellular phones can be used indefinitely for this application.

John Pryma is vice president of structured cabling at Genesis Cable Systems LLC (Pleasant Prairie, WI).

Residential wiring standards currently a jigsaw puzzle

Arlyn S. Powell, Jr.

If you think it is difficult to understand the subtleties of commercial-building wiring standards, and if you believe it is almost impossible to keep up with the rapidly changing guidelines that affect design, installation, and maintenance in this area, you are likely to find the residential and small-office/home-office market even more daunting.

Although it would be correct to say that a single residence should be simpler and quicker to cable than a large enterprise network, you have the problem of integrating many low-voltage specialties that are spread among a number of different trades in commercial work. And then again, a multitenant building may not be that much smaller or less complicated than a modest-sized commercial enterprise.

Here's a brief rundown of residential and light-commercial cabling standards:

Commercial

BACnet is a standard of ASHRAE, the American Society of Heating, Refrigerating, & Air-Conditioning Engineers (Atlanta). ANSI/ASHRAE standard 135-1995, adopted in 1995, is an open-communications protocol developed to standardize communication between building-automation devices from different manufacturers. BACnet can be used with five different networking protocols, the fastest being Ethernet. BACnet is independent of LonWorks, but is often used in conjunction with it. Currently, BACnet is used for higher-level communication between systems and subsystems, while LonWorks is reserved for lower-level, peer-to-peer communication between sensors and controllers. For more information, check out www.bacnet.org and www.bacnetassociation.org.

LonWorks, whose name comes from LON, or "local operating network," is an open architecture developed by Echelon Corp. (Palo Alto, CA) that permits interoperability between different manufacturers' products over a variety of media. It is one of the most widely implemented building-automation architectures. Products use Echelon's Neuron microchip to achieve real-time interoperability between control systems. Each LonWorks node is linked to a channel; for example, to a twisted-pair, coaxial, or fiber-optic cable, or to a power line or radio frequency. The entire control network operates under the LonTalk protocol, which is in turn one of the approved carriers of BACnet messages. More information can be obtained at www.lonmark.org.

TIA/EIA-568 and 569 are, respectively, the commercial building wiring standards covering cable and components and architectural pathways and spaces. First developed in the late 1980s and early 1990s by the Telecommunications Industry Association (TIA-Arlington, VA), a subgroup of the Electronic Industries Alliance (EIA-Arlington, VA), the two standards are updated regularly and are now into their second and third (A and B) versions. Supplemented by standards for infrastructure administration (TIA/EIA-606) and electrical grounding and bonding (TIA/EIA-607), the 568 and 569 standards specify coaxial, shielded and unshielded twisted-pair, and optical-fiber cables for commercial and other organizations.

Residential

CEBus, or Consumer Electronic Bus, is governed by the EIA-6000 standard and is used to establish a residential control network employing a variety of media, including AC power lines, telephone wire, coaxial cable, and wireless. CEBus uses the Common Application Language, or CAL, to communicate commands over its lines, and the Home Plug & Play specification provides a uniform implementation of CAL with household devices. The CEBus Industry Council (CIC) supports this effort. For more information, see www.cebus.org.

FireWire, otherwise known as IEEE-1394, is maintained by the Institute of Electrical and Electronics Engineers (IEEE-New York City). Based on a proprietary Apple design and ratified by the IEEE in late 1995, this document is officially known as the Standard for a High Performance Serial Bus. The protocol allows for moving data between computers and peripheral devices at speeds up to 400 Mbits/sec. It also permits the interconnection of consumer digital-electronic devices, such as video camcorders, video-disk players, set-top television boxes, and audio systems-all of which may be linked to a personal computer. Analysts expect FireWire to interconnect with Asynchronous Transfer Mode-based telephone networks, securing a long life for the protocol. For more information, see the IEEE's specialized Website at www.1394ta.org.

HomeRF is an open specification for establishing wire-less digital communication between personal computers and consumer devices in and around the residence. See www.homerf.org.

HomePNA is the product of the Home Phoneline Networking Alliance, an association of more than 120 companies working together to develop a single phone-line networking standard. The de facto standard issued by the two-year-old organization is dubbed the 1.0 Specification, standing for 1 Mbit/sec. Within the past year, the 2.0 Specification has been issued to cover technology operating at up to 10 Mbits/sec. See www.homepna.org.

TIA-570, currently in its A revision, is the residential telecommunications wiring standard adopted by the TIA. It specifies the physical-layer platform for accommodating all low-voltage applications in the residence: voice, video, data, alarm, and security, as well as automated heating, ventilating, and air-conditioning system (HVAC) control.

UpnP is the result of an agreement between Microsoft Corp. (Redmond, WA) and ITRAN Communications Ltd. (Beer Sheva, Israel), a developer of hardware and components for the powerline communications industry. The agreement is aimed at standardizing the efforts of powerline carriers (PLCs) to deliver home-networking technologies. For more, see www.upnp.com.

In addition to these specific low-voltage standards, other standards and regulations of course apply, among them the building code used in a particular geographic region, the National Electrical Code (NEC, or NFPA-70), the National Electrical Safety Code (NESC), and any relevant jobsite safety regulations of the Occupational Health and Safety Administration (OSHA-Washington, DC).

BICSI tackles home and building automation

Perhaps the most telling example of the growing interest in home and building automation was a recent technical seminar on intelligent buildings held for members of BICSI (Tampa, FL). The six featured speakers were Jack Fraser of Continental Automated Building Association (CABA-Ottawa, ON, Canada), Greg Weldon of AMP (Harrisburg, PA), Morris Stelcner of NORDX/CDT (Pointe-Claire, QC, Canada), Darold Hanson from Honeywell (Minneapolis, MN), Brian Kammers of Johnson Controls (Milwaukee, WI), and Don Coover of Lucent Technologies (Murray Hill, NJ).

The seminar was coordinated by CABA and opened with remarks from Fraser, who noted CABA's membership had grown to about 300 since it was founded in 1988. Along with the companies providing speakers for the seminar, the CABA membership list includes such companies as Motorola and Microsoft.

Presenting a market perspective on intelligent buildings was Greg Weldon, director of global premises systems engineering at AMP. The goal of the intelligent-building movement, he said, is to create a building that operates efficiently and is more comfortable for the occupants. This is done by integrating voice and data systems with building controls, such as fire, life and safety, access, lighting, and security systems.

Standards already exist for both communications and control systems, he added. The issue that could hinder the intelligent-building concept is not how to overlay control systems over structured cable, but the need to optimize connectivity for control systems so that the intelligent building will work effectively.

Morris Stelcner, product manager for intelligent buildings and smart homes with NORDX/CDT, cited an example of how an intelligent building functions. "I've seen systems where you can access building management through the network at any PC," he said, adding that gigabit speeds are needed for this type of network.

Stelcner also pointed out that, in case of a fire, an intelligent building would trigger fire alarms, which would then communicate to the heating, ventilating, and air-conditioning system (HVAC) to shut vents and prevent the spread of smoke and fire. Meanwhile, a distress signal would immediately have been dispatched to firefighters.

When planning for an intelligent building, Stelcner recommended convincing the building owner "that there is value in having one comprehensive system and using the same principles set for in the EIA/TIA-568 standard, which mandates a star topology."

He also added that the installer and contractor need to work together to see the project through. An intelligent building infrastructure, Stelcner said, will initially save the owner 10% to 20% in labor costs. An additional 30% to 50% savings in operating cost can be attained over five years. Also, integrating building systems increases the value and marketability of the property, increases tenant satisfaction, and minimizes risk and liability.

Darold Hanson, national manager for integrated systems building controls for Honeywell, went over the framework of a building automation system (BAS). Brian Kammers, program manager of facility management systems for Johnson Controls, described BAS communication networks.

Wrapping up the half-day seminar was Don Coover, director of systems engineering for Lucent Technologies (Murray Hill, NJ). Coover's presentation summed up how BASs are integrated with telecommunications. The designer, he said, should work with the BAS vendor to determine mechanical-equipment locations, horizontal-cable pathways, BAS-controller and device sites, as well as deciding which and how many controllers and other devices should be connected to each horizontal cable. As far as BAS cabling elements go, Coover said backbone cable can be shared, but binder groups must remain separate. He also stated that patch cords should not be used, and red insulator slips should be attached to identify BAS components. Differently colored crossconnect wire ought to be considered as well.

Horizontal cabling options that can be used include: zone crossconnect, fault-tolerant circuits, chained branches, and single-point branches or circuits. Furthermore, Coover said, labor can be reduced by consolidating cabling and pathways. This works best if one project team designs, installs, and manages the job.

To find out more about residential wiring

In addition to Cabling Installation & Maintenance, which frequently carries coverage of residential and small-office/home-office wiring issues, there are many other resources that can inform you about this dynamic and expanding market. Here is a listing of some recent coverage in our magazine. Also, watch for the Home Networking Supplement accompanying next month's November issue.

Recent articles in Cabling Installation & Maintenance include:

"Ask Donna," Donna Ballast, January 2000, page 12

"Evolution of the residential-gateway concept and standards," Hongjun Li, January 2000, page 35

"Wiring up for cable TV and satellite," Donna Ballast, May 2000, page 12

"Residential wiring for the new millennium," Steven Totolo, May 2000, page 29

"FCC mandates Category 3 for all new projects," Patrick McLaughlin, May 2000, page 30

"PANs give new dimension to wireless connectivity," Dan Sweeney, May 2000, page 103

"Smart phones still waiting in the wings," Dan Sweeney, May 2000, page 109

"Category 3 minimum FCC-approved for all new copper-cabling installations," Steve Smith, May 2000, page 119

"A wired-home boom? Depends on where you live," Steve Smith, May 2000, page 120

"Boom market ahead for copper-based, wireless home networks," Steve Smith, August 2000, page 126

"Mastering disaster," Arlyn Powell, August 2000, page 142