Market saturation will lead to single-digit growth in the coming years, a new report says.

Frank Murawski / FTM Consulting

Since last year, it has become apparent to those who closely study the activities in the premises-cabling system marketplace that the overall market has slowed down. In fact, it's fair to say that the consumption of cables and associated connecting hardware has slowed dramatically. At one time, Category 5 cables were shipping as quickly as manufacturing plants could produce them. Today, however, those same cables have borne the brunt of the market slowdown.

Contrary to popular belief, the culprit in this market slowdown is neither the year 2000, or Y2K, situation nor other interim problems that will soon go away. Rather, the reason for the current and future market slowdown is a very permanent market dynamic that I call "market saturation."

All successful business markets pass through several phases in their lives, beginning with an embryonic phase, followed by a growth phase, and finally, a mature phase. The typical market curve for these phases shows slow growth during the embryonic phase, a steep incline during the growth phase, and a plateau through the mature phase. I contend that the cabling-system market has entered its mature phase, which I am calling "market saturation."

Data cabling is key

The premises-cabling market includes two major applications: voice communications and data communications. The voice segments include interlinking telephones in buildings to the telephone companies' external trunks via private branch exchanges, key systems, or other systems. The data-communications segment concerns itself with connecting local-area-network (LAN) nodes.

Recently, data-communications cabling has heavily influenced the overall premises market, because many buildings have been deploying LANs for the first time. And for the most part, these same buildings' telephone systems have been in place for a long time. As a result of this dynamic, most of the growth in cabling systems since 1995 has been due to the installation of new LAN cabling.

The key subsystem within LAN data-cabling systems is the horizontal cabling used to carry data. The horizontal-cabling segment is the largest single segment of the entire premises-cabling-systems market. Recent studies of the premises-cabling market that I have conducted indicate that horizontal systems account for more than two-thirds of the total premises market.

End-user organizations

In terms of end users-those who actually consume and ultimately use communications cabling systems-Fortune 1000 companies represent the largest segment. Although this segment incorporates the smallest number of companies, it represents by far the largest number of workstations to be cabled. I have classified end-user organizations into three groups:

- Fortune 1000 companies, of which there are several hundred firms.

- Medium-sized companies, defined as those with between 100 and 1,000 employees. Thousands of companies fall within this segment.

- Small offices and home offices, including any organization with fewer than 100 employees. Millions of companies/locations fall into this segment.

Based on my research, I believe that all Fortune 1000 firms had installed LAN cabling systems at all of their major locations as of last year.

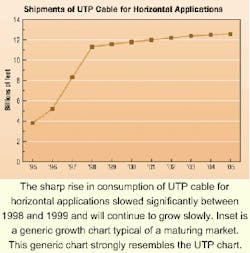

In tracking the premises-cabling-system market for the past 15 years, I have amassed an expansive database of market figures detailing various product-type shipment figures. Unshielded twisted-pair (UTP) cable intended for horizontal applications is probably the single-most important indicator of the market's health and direction. With that in mind, the historical and projected figures for this product type are compelling. Shipments rose from 3.8 billion ft in 1995 (the first year that Category 5 cable was available) to 11.6 billion ft in 1999. However, projections call for that figure to climb only to 12.6 billion ft between now and the year 2005.

The growth curve associated with these actual and projected shipment numbers strongly resembles the aforementioned typical curve of a maturing marketplace.

Further examination

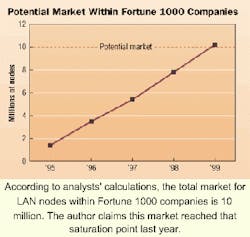

A check of actual cable shipments through the first part of this year indicates that growth is indeed in the single-digit range. With this information in mind, I analyzed my database a little more thoroughly to calculate the potential market for nodes within Fortune 1000 companies that needed cabling, irrespective of whether those nodes had already been cabled. That market amounts to 10 million nodes. Further calculation indicates that in 1999, the number of installed nodes within all Fortune 1000 companies exceeded 10 million. I believe that this market saturation is exactly the genesis of the current market slowdown.

The implications of these findings on cabling-system vendors are enormous. No longer can manufacturers push out capacity from their factories and expect the market to immediately gobble it up. For the first time in this marketplace, a lack of market demand is causing a weakness in market growth. Historically, capacity constraints or materials shortages-not lack of demand-slowed growth.

Vendors that have had double-digit growth over the past several years now must live with single-digit growth rates. The days of 50% growth rates for UTP cable shipments, and even the 20% to 30% growth rates between 1995 and 1998, are behind us. The actual growth in 1999 was only 2.6%-a substantial decrease from the previous four years. I project even smaller growth than that for this year: 1.2% total. In fact, for the total cabling-system market, I forecast an annual growth rate of only 3.2% over the next five years.

Future drivers

Some markets flatten out or actually start to decline when they reach the maturity phase. I believe that the cabling market has the resilience to afford small growth through its mature phase. Also, I have determined that several drivers will push this modest growth, now that the Fortune 1000 firms have satisfied their initial cabling needs. These new drivers include:

- A need to install new systems to support Gigabit Ethernet, at least on a departmental level, using Category 5E cabling. This is a near-term driver that will affect the market over the next two years.

- New broadband applications, such as e-commerce and high graphical content over servers, spurred by the Internet. This is another near-term driver, which I expect to hold for about three years.

- Very small firms requiring initial LAN cabling installations. Following in the footsteps of the Fortune 1000s, many recent startup companies will require network connectivity over the next four years. This is a mid-term market driver.

- Applications, not defined today, requiring broadband capabilities with high-performance cabling such as Category 6 and Category 7. This market driver will have more long-term (longer than four years) impact.

- Large contract awards, such as those for sports stadiums, recreational theme parks, airport terminals, and other large facilities. These large contracts will spawn growth throughout the forecast period. They will include projects at growing Fortune 1000 firms that relocate to larger facilities or add remote facilities because of business expansion.

Beyond the five-year horizon, fiber-to-the-desk will finally become a major development that will negatively impact UTP cable shipments. However, I want to stress that this is an eventuality-reaching beyond my five-year crystal ball.

Bad news/good news

For cabling-system vendors, the current market saturation results in both bad news and good news. The bad news is obvious: Historical double-digit industry growth is now replaced with single-digit growth projections. The good news is that a large market base can be sustained and even grow to a small extent over the next five years.

With more than 10 billion ft of UTP cable being shipped each year, for a cumulative number of 50 billion ft over the next five years, the size of this market is awesome. On a total-dollar basis, the cabling-system market is expected to be in the $4-billion range each year through 2005. Even small shares of this large market can provide suppliers with a solid business opportunity. With these smaller market growths, leading cabling vendors should not expect to increase market share significantly in the future.

With this new market paradigm in place, manufacturers must develop new strategies to maintain a competitive position within the marketplace. I believe one such strategy, especially for leading vendors, is to focus on specific vertical-market segments. This strategy could include optimizing cabling systems for hospitals, schools, warehouses, retail stores, or other end-user organizations. Or a vendor can take the approach of directing its systems to a broader market, such as the building automation and controls market. For example, a very large vendor in the premises-cabling industry recently announced partnerships with several building-automation and controls suppliers to integrate the vendor's communications cabling system with buildings' communications and control systems' cabling infrastructures. Another strategy that larger vendors might consider is to team up with large network- system integrators.

Smaller vendors should consider developing leading-edge technology products for future Category 6 or Category 7 cabling systems. Or, at a minimum, they should team up with vendors that have these newer technologies.

The market-saturation effect will surely ripple through the premises-cabling industry. Be aware of the implications it can have on you as a designer, installer, or user of these systems.

Frank Murawski is president of premises-cabling consulting firm FTM Consulting (Hummelstown, PA). He has compiled his research of the market in a report that is available through World Information Technologies (Northport, NY). Murawski can be reached at tel: (717) 533-4990. The phone number for World Information Technologies is (631) 754-5700.