DCIM market pegged at $280M for 2014, 26-percent CAGR projected

The global DCIM—data center infrastructure management—market will reach $280 million this year, according to “DCIM Report – 2014” recently published by IHS. “Global revenue from the DCIM suite products … is forecast to grow 30.6 percent in 2015,” the research organization said, adding: “IHS defines ‘DCIM suit’ offerings as those that interact with three or more functional areas of the data center—power, cooling, space/environment, cabling, networking and connectivity, and servers and storage.” The study defines some of the components included in DCIM suites and identifies vendors offering them.

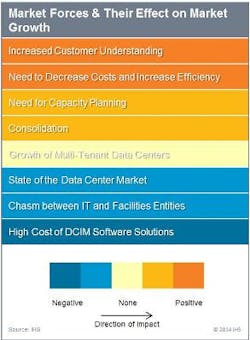

“IHS estimates that the DCIM suite market will grow at a compound annual growth rate of 26 percent through 2019, based on balancing the influence of a number of drivers and inhibitors,” the firm said. “As a still emerging market … DCIM suite revenue will continue to grow at impressive rates. However, the growth inhibitors at play in this market should not be overlooked and may lead to overall growth rates slightly lower than what was originally expected by vendors and market analysts.”

Here are those drivers and inhibitors, listed and described in order of positive (driver) to negative (inhibitor) impact on the DCIM market, as explained by IHS.

Increased Customer Understanding—Customers are increasingly aware of what DCIM is and the benefits it provides, which makes it easier for suppliers to sell these solutions. Beyond that, IHS believes this will also lead to a decrease in the amount of DCIM software that is given away as a free trial or at discounted rates [which are] practices that inhibit revenue growth in the short term.

Decreasing Costs and Increasing Efficiencies—This is certainly a driver of DCIM market growth to some degree. Vendors are providing case studies proving that DCIM, when used to its fullest potential, can help data center managers decrease costs associated with running a data center and increase efficiencies in the user of power, space, cooling, and IT equipment. This growth driver does come with the caveat that it is more applicable to existing data centers than newly built data centers, which tend to incorporate the latest technologies and facility design, making efficiency inherent.

Capacity Planning—Data center managers are motivated to use available space, power and compute capacity as efficiently as possible, so the capacity planning components offered in DCIM suites make this a driver of DCIM adoption in many cases. However, IHS has seen evidence that there is overcapacity in the data center market right now, meaning that data center managers may not be as concerned with this problem as they have been in the past.

Consolidation—Consolidation continues to be a key strategy for reducing data center costs, and the change management, capacity planning, and workflow components of DCIM software can be very helpful in consolidation situations, making this one ore motivation for adoption.

Multi-Tenant Data Centers—A number of DCIM offerings have features designed specifically for use in multi-tenant environments, which provides additional motivation for this fast-growing sector of the market to adopt DCIM. However, many multi-tenant data center operators offer their own proprietary DCIM products to their customers, providing competition for traditional DCIM suite vendors in this environment.

State of the Data Center Market—As outlined in another recent IHS post, certain segments of the data center market are growing substantially (e.g., multi-tenant data centers), but the market as a whole is not doing as well as one might think. One factor dampening growth is the more efficient use of space and compute. Many DCIM software offerings are priced based on number of racks, number of devices, or number of MW that the customer wishes to monitor, and because of this, the same efficiencies that are dampening data center market growth are likely inhibiting DCIM suite revenue growth to some degree as well.

Chasm Between IT and Facilities—The fact that IT management and facilities management are traditionally siloed creates a compelling argument for adopting a DCIM suite, because these solutions unit management of both areas into one dashboard and reporting software. However, this same problem also makes choosing and purchasing a solution much more difficult and often inhibits the adoption of DCIM.

High Cost of DCIM Suite Solutions—The high cost of the software license and associated service fees has been a barrier to adoption, especially in cases where customers are not convinced of the return on investment.

The study was researched and authored by Sarah McElroy; interested parties can contact McElroy ([email protected]) for more information.