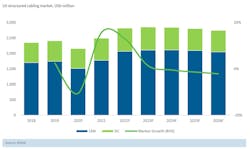

U.S. structured cabling market recovering strongly from COVID downturn

Recently published insight into global markets for structured cabling shows that most of the world spent 2021 recovering from the COVID downturn, but supply issues hampered growth for some. Published by BSRIA, the World Market for Structured Cabling includes a report on the total global market, as well as individual reports on 16 countries and regions: the U.S., Canada, Brazil, Mexico, Chile, China, Australia, India, Southeast Asia, Germany, the U.K., France, Spain, Belgium, Portugal, and Sweden.

“Many countries experienced a drop in sales of copper products installed mainly in LAN applications in 2020, but recovery has been rapid in some countries,” BSRIA said when announcing the study’s availability. “The data center market displayed strong growth in most countries, including the U.S., in 2021. The U.S. data center market is mature, and declined slightly in 2020 due to lockdowns and social distancing rules.”

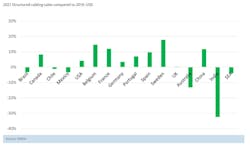

Overall, the global market grew by 13% in 2021 to US$6.98 billion for all the countries BSRIA tracks. “That equates to a marginal increase compared to the market value in 2019,” the firm explained. “Growth was generally highest in the countries that suffered most in 2019, such as Brazil, Chile, Mexico, Canada, U.S., France, U.K., Spain, and Southeast Asia—while India and Australia did not recover.”Overall the global market declined by 10% in 2020, measured in USD. The worst-hit markets were India and Brazil, followed closely by Canada. Many countries experienced decreased between 10 and 15%, while a few countries—China, Sweden, Portugal, Belgium, and Germany—did reasonably well that year.

“The increase in market value in 2021 was fueled by price increases, which affected the markets unevenly, with price upturns varying from a few percentage points to 20-30%,” BSRIA pointed out. “However, the picture is very different if we look at the amount of copper cable sold measured by volume, with only Sweden, China, and Spain exceeding their 2019 sales. The U.S. performed reasonably well, only a few percent below 2019. Most countries are 10 to 15% below 2019 sales.”

About the Author

Patrick McLaughlin

Chief Editor

Patrick McLaughlin, chief editor of Cabling Installation & Maintenance, has covered the cabling industry for more than 20 years. He has authored hundreds of articles on technical and business topics related to the specification, design, installation, and management of information communications technology systems. McLaughlin has presented at live in-person and online events, and he has spearheaded cablinginstall.com's webcast seminar programs for 15 years.