Will POL market soar with Nokia, Huawei on board?

As we reported in our March issue, BSRIA recently analyzed the passive optical LAN (POL) marketplace (“Researcher says passive optical LAN market poised to take off”). Among the conclusions it reached was that the market “will only really take off when a big player or several medium sized players enter the market with a clear go-to-market strategy …” In early April, Nokia announced its entry in the POL market. Nokia may very well be the big player that BSRIA said will be needed to enjoy a hockey-stick growth curve.

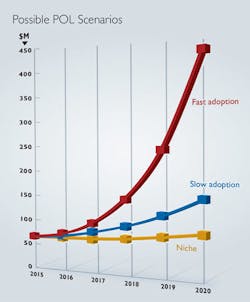

In a private presentation that took place in early February, BSRIA presented information on the POL market to several cabling-industry vendors. As part of that presentation, BSRIA unveiled the graph that appears on this page. The graph depicts POL market growth curves under three scenarios: the technology remains niche; it experiences slow adoption; or it enjoys fast adoption. As the chart indicates, the POL market is pegged at approximately $75 million this year regardless of which path it ultimately takes. But if everything lines up right for the POL market and it experiences fast adoption, the total market could pass $100 million next year and eclipse $150 million in 2018.

Under any scenario, the growth path charted by BSRIA has the POL market exceeding $100 million by 2020. However, depending on which path the market takes, by that year-2020-it could be anywhere from approximately $110 million to approximately $425 million.

When announcing its entry into the passive optical LAN market, Nokia quoted Erik Keith, principal analyst for broadband networks and multiplay services at Current Analysis. Keith said, "We've seen interest in POL increase dramatically over the past few years as enterprises around the world have come to realize the substantial service delivery and operational efficiency advantages that POL architectures provide over Ethernet-based LANs. We expect to see accelerated momentum in the POL space as Nokia and other major vendors enter the market and provide compelling, future-proof alternatives to the existing Ethernet LAN model."

The fact that a Nokia brand-name passive optical LAN system has reached the market results from the long-in-the-works merger of Nokia and Alcatel-Lucent. The network equipment in the system is Alcatel-Lucent hardware. The two organizations began operating as a joint company in January.

If Nokia's entry alone doesn't put POL on the fast-adoption track indicated in the graph above, perhaps Huawei's entry into the market will do the trick. It launched the AgilePOL solution at CeBIT in March and had joined the Association for Passive Optical LAN in February. At the time it joined the APOLAN, Huawei demonstrated several POL solutions.

With the entry of these high-profile network vendors, and perhaps others in the future, the next handful of years will be telling for the passive optical LAN market.