Fiber to conquer premises data networks?

Twisted-pair copper will finally take a back seat in premises applications, according to North American sales projections.

Stephen Montgomery, ElectroniCast Corp.

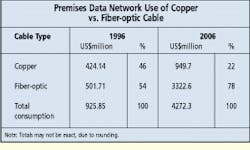

For the first time, copper cable--predominantly twisted-pair--had to settle for second place in the premises data network sweepstakes. Copper`s share of the North American data cable market in 1996 was 46%, or $424.1 million. The rapidly rising data rates of individual machines and the increasing complexity of local area networks (lans) are pushing the interconnect cable market into a greater use of fiber-optic cable.

This trend is being accelerated by aggressive new product developments and cost reductions in optoelectronics and other fiber-link elements, making fiber cost-competitive with copper on a life-cycle basis. The use of fiber-optic cable in premises data networks will rise to a 78% market share, or $3.32 billion, by 2006. (All values and prices in this report are at factory as-shipped levels, and are in current dollars, which include the effect of a forecasted 5% annual inflation rate over the forecast period.)

Fiber-optic cable in lan/premises data networks will remain mostly multimode. Singlemode fiber cable typically will be used for longer-distance links (2 kilometers) and links requiring higher data rates. (Note that ElectroniCast classifies the longer-distance links--2 km--as private data networks. This article addresses the consumption value of fiber-optic links of less than 2 km only.) Meanwhile, copper will trend to Category 5 unshielded twisted pair (utp).

Multimode rules

Singlemode fiber cables represented 12% of North American premises data network consumption in 1996. This percentage will increase to 23%, or $73.4 million, in 2006. Singlemode fiber use will be mainly in campus interbuilding applications, to accommodate high data rates plus several-kilometer distances. Singlemode use in in-plant backbone interconnects also will rise rapidly. Multimode (including plastic-clad and plastic) fiber cable growth in lans also will remain impressive, with value advancing by nearly six times over the 1996 to 2006 span.

Conversely, coaxial cable, once so prevalent in lans, is disappearing as a medium of choice and has been dropped from the standards-based model as a recommended medium for new construction. In twisted-pair cable, Category 3 and 4 are rapidly being displaced by Category 5. The Category 3 to 4 market has peaked and will decline over the forecast period. Category 5 will achieve impressive growth through 2001, then experience slower growth as fiber feeds closer to the desk. Neverthe- less, by 2006, Category 5 will hold a 97% share of copper data-interconnect cable value (including "next generation" or "enhanced Category 5").

Structural categories

Premises data network wiring is defined primarily by its location within the plant structure. However, cables also can be defined by their jacketing type; that is, the operational ratings of the jacketing material. ElectroniCast segments cables according to their structural category as follows: work area, horizontal cable, riser backbone, campus backbone, equipment room, and administration.

These cabling subsystem application categories are based on the eia/tia-568 Commercial Building Wiring Standard. In the United States, this standard has evolved since its approval and publication in 1991 to guide the design of wiring systems that support a multivendor, multiproduct environment. Internationally, a building wiring standard is being developed as part of the International Standards Organization/International Electro- technical Commission. (iso/iec--Geneva).

Standards are typically based on a star topology in which each workstation is connected to a telecommunications closet situated within 90 meters of the work area. Backbone wiring between communications closets and the main crossconnect is also organized in a star topology. However, direct connections between closets are allowed to accommodate bus and ring configurations. The distances between closets and the main crossconnect depend on backbone cable types and applications.

In the most popular cable categories--Category 5 twisted-pair and fiber-optic cable--ElectroniCast has further segmented the cables according to their jacketing rating: either plenum or riser (nonplenum; typically polyvinyl chloride [pvc] jacketing). Nominally, plenum cable is installed in the building plenum (part of the workplace environmental air circulation system). Because the plenum generally is found between the floor of one level and the "drop ceiling" of the next-lower level, it is considered horizontal wiring. Conversely, riser-rated cable is installed in the vertical run of multilevel structures, such as within elevator shafts.

Plenum cable is rated for nonflammability and very low levels of smoke and toxicity under exposure to fire. Riser-rated cable jacket and insulation ratings are much less stringent, and thus typically use cheaper materials, such as pvc.

Wedding categories with jacket types, horizontal cable is installed mainly in plenums and is plenum-rated, but a small share is installed within floor trenches and sub-carpet; in these instances, riser-rated cable may be used. More significantly, riser-rated cable jacketing and interior construction have been improved to the point that riser-rated cable can be used for interbuilding interconnect applications. Such use represents a substantial share of fiber-optic riser-rated cable sales.

The picture is complicated by the fact that electrical architecture engineers increasingly are specifying plenum cable for traditionally nonplenum applications. This is especially prevalent when using fiber-optic cable, where the price premium for plenum rating is only 10% to 15% (vs. about 100% for twisted pair--down from 1000% 10 years ago).

So our analysis and forecast show some penetration of plenum cable into riser and other structural locations. The reason for this trend is that if a total wiring system bill of materials calls for plenum cable for some locations and riser-rated for others, Murphy`s Law dictates that riser-rated cable occasionally will mistakenly be installed in plenum areas--later to be ripped out and replaced at high cost. To prevent such mishaps, network planners increasingly are specifying all-plenum cabling.

Backbone cable is defined by its functional position in the hierarchy of its network. It transports a much higher data rate (typically 10 to 100 times higher) than its tributary branches. It may be singlemode or multimode fiber-optic, coaxial, or Category 5 twisted-pair cabling. Category 5, for example, can be used as a 100-megabit-per-second backbone for a dimensionally small lan with a number of 1.5-Mbit/sec nodes, even a few Ethernet or Token Ring nodes. Typically, however, backbones run relatively long distances--from hundreds of meters to a few kilometers; generally, therefore, they most commonly require fiber-optic cabling. The backbone cable usually is structurally riser and campus (interbuilding). Its jacketing can be either plenum or riser-rated.

Riser links accounted for 43% of 1996 interconnect cable consumption, or $400.6 million. Almost all of the fiber-optic cable used in the riser backbone is multimode. The riser link share will increase to 44% ($1.88 billion) by 2006.

Riser-rated cable is used both in-plant (intrabuilding) and to connect nodes in different buildings of a campus topography (interbuilding). The continued growth in the later years of the survey will be driven by a move to higher-bandwidth lan backbones, transmitting at 2.4 and 10 gigabits per second, plus the continuing demand for upgrading older networks to accommodate higher data rates. Expansion of the average lan, both in interbuilding connections and in number of nodes, also will drive this trend.

This article is reprinted from the September 1997 issue of Lightwave, another PennWell publication.

Stephen Montgomery is president of ElectroniCast Corp., based in San Mateo, CA. He may be reached at tel: (650) 343-1398, fax: (650) 343-1698, or e-mail: [email protected].