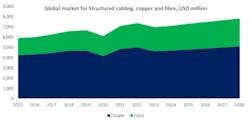

According to BSRIA’s most recent analysis, the global structured cabling market decreased by almost 6% in 2023 to $US 6.98 billion, after enjoying 4% growth in 2022 and 16% growth in 2021. “Sales of copper cable and connectivity suffered the most, decreasing by just over 7%, while fiber declined only slightly,” BSRIA stated when announcing the availability of its latest research into the worldwide market.

“The supply issues and shortage of materials experienced in most markets in 2021 and 2022 meant that the channel boosted levels of stock in most markets at the end of 2022,” the organization continued. “That affected sales in the first half of 2023, in addition to a reduction in demand due to a slowdown in the office vertical, high interest rates, lack of investment and the threat of recession in many countries.”

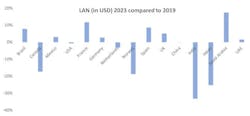

BSRIA, which examines the structured cabling markets in 37 countries, added that two-thirds of those countries have recovered or are exceeding pre-pandemic LAN sales levels, measured in U.S. dollars. The biggest increases came in Saudi Arabia, France, Spain, and Brazil. “At the other end of the scale, India, Japan, Norway, and Canada are struggling to recover,” BSRIA said. “Looking at the recovery measured by copper cables sold, only a few countries have performed well, including Spain, Sweden, and Finland. Nearly all countries are below or far below pre-pandemic levels. The recovery in LAN value is mainly due to the significant price increase seen over the last three years, but also due to an increased in sales of higher-value products such as Cat 6A.”

Analyzing the dichotomy of LAN cabling and data center cabling, BSRIA observed, “The data center market decreased marginally in 2023, with the sector facing the same issues as LAN, as well as a reduction in new permits for data centers in some cities and areas. Power restraints will be a key issue over the forecast period [through 2028]. Demand for data center power has grown exponentially and in the future, the sector will face competition from electrical vehicle and some sectors of manufacturing.

“The European commission estimates an increase in power consumption of 60% by 2030. In addition, power generation needs huge investments in most countries to meet green/renewable targets.”

You can find BSRIA's most recent global research documents here.

About the Author

Patrick McLaughlin

Chief Editor

Patrick McLaughlin, chief editor of Cabling Installation & Maintenance, has covered the cabling industry for more than 20 years. He has authored hundreds of articles on technical and business topics related to the specification, design, installation, and management of information communications technology systems. McLaughlin has presented at live in-person and online events, and he has spearheaded cablinginstall.com's webcast seminar programs for 15 years.