Ethernet switch market 'moderately improving'; router market 'stays flat'

International Data Corporation (IDC) recently reported that the worldwide Ethernet switch market (Layer 2/3) exceeded $6.1 billion in revenue in the third quarter of 2015 (3Q15), an increase of 2.0 percent year over year and a healthy increase of 6.1 percent quarter over quarter, in terms of growth rate. However, the researcher also noted the worldwide total enterprise and service provider (SP) router market could not repeat its exceptionally strong growth from the previous quarter, and ended 3Q15 flat on an annual basis, and down -7.2 percent quarter-over-quarter.

Significantly, IDC found that the worldwide enterprise and SP router market was flat on a year-over-year basis in 3Q15, as the 1.1-percent annual increase in the SP segment was offset by a -3.5-percent decline in enterprise routing. The researcher stated that this will be a market to watch closely over the coming quarters, as software-defined architectures start to take hold across the WAN, enabling enterprise network managers and service providers alike to benefit from these emerging capabilities.

IDC added that 10-Gbit Ethernet switch (Layer 2/3) revenue decreased -1.6 percent year over year, coming in at $2.2 billion, while 10-Gbit Ethernet switch port shipments grew a robust 27.4 percent year over year, with nearly 8.5 million ports shipped in 3Q15, as average selling prices continued to fall. Meanwhile, IDC found that 40-Gbit Ethernet revenue reached a record $644 million in 3Q15, growing 41.4 percent year over year.

“Overall revenue and port shipment growth rebounded somewhat in 3Q15, even though the usually strong 10G segment continued to see weakness in year-over-year revenues,” explains Rohit Mehra, vice president, network infrastructure, at IDC. “At any rate, shipments of 10-Gbit Ethernet and higher speeds is a testament to the strong demand to support a diverse array of enterprise and data center workloads and service provider infrastructure. Given this, we expect the market to remain relatively healthy, but intensively competitive.”

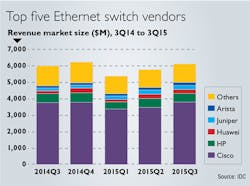

In terms of specific vendor highlights, IDC reported that Cisco finished the quarter with 0.8-percent year-over-year growth in the Ethernet switching market and market share of 61.6 percent, up slightly from its 60.1 percent share in 2Q15. In the hotly contested 10-GbE segment, Cisco held 59.1 percent of the market in 1Q15, up from 57.6 percent in the previous quarter, but down from the 63.4 percent it held in 3Q14. IDC noted that Cisco’s SP and enterprise router revenue decreased -2.3 percent year-over-year.

Elsewhere, the analyst said HP’s Ethernet switch revenue came in essentially flat on both an annual and sequential basis in 3Q15. However, Juniper posted a record quarter in Ethernet switching, with a year-over-year increase of 39.4 percent and sequential growth of 6.5 percent in 3Q15. Its router revenue was flat sequentially but increased 11.0 percent year over year in 3Q15, reportedly due to a robust 20-percent year-over-year increase in sales of core SP routers.

“While demand for higher speeds such as 10-Gbit and 40-Gbit Ethernet increases, declining average switch port selling prices have had a flattening effect on overall market growth,” concludes Petr Jirovsky, research manager in IDC’s networking trackers group. “The emergence of speeds such as 2.5-, 5-, 25-, and 50-Gbit Ethernet, along with 100-Gbit Ethernet reaching critical mass over the next few years, will make this an interesting market to watch.”