Driven by hyperscales, global data center server market forecast to hit $56B by 2021

According to a recent market study by Technavio, the global data center server market’s size is projected to reach USD $56 billion, growing at a CAGR of close to 5 percent over the study’s forecast period. Titled “Global Data Center Server Market 2017-2021,” the analyst’s report provides analysis of the market in terms of revenue and emerging trends. The report also includes up-to-date analysis and forecasts for various market segments and all geographical regions.

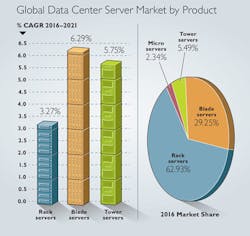

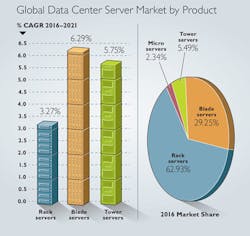

According to the study’s executive summary, “Servers are the backbone of a data center operation...the rising number of hyperscale data centers for analytic applications such as big data analytics will be a key driving factor for the data center server market.” Based on product, the report categorizes the global data center server market into segments for rack servers, blade servers, tower servers, and micro servers. Rack, blade and tower models are the top three revenue-generating product segments, states the report.

Observations on each market segment from Technavio are as follows.

“Rack servers are traditional data center servers, which account for a majority 63 percent of the overall market revenue generation,” says Abhishek Sharma, one of the lead analysts at Technavio for data center research. “Rack servers contribute significantly toward the growth of the data center server market through continuous innovations by vendors and component manufacturers. Most of the enterprise data centers currently in operation opt for rack servers, which brings in a significant amount of revenue to the market. The adoption of these servers will continue to increase because of the enterprise preference and expertise in operating these servers, pushed by continuous innovations in compute power and energy efficiency by vendors.”

“Blade servers are extremely compact and designed to be installed with chassis,” notes the report’s executive summary. “The support infrastructure required for blade servers are supplied by the chassis, and their performance is comparable to that of rack servers. The blade servers have relatively simple cabling, have better load balancing, and are very efficient through integrated Ethernet and Fibre Channel switches, thus driving for their increasing adoption. Additionally, small and medium-sized enterprises (SMEs) looking to co-locate racks will mainly opt for this type of server.”

“Tower servers are mainly used in the standalone form, and provide cooling and scalability provisions. They have fairly complex cabling and are mainly compatible with high-end servers,” adds Sharma. “SMEs are the main end-users of these towers. Many tier 1 and tier 2 data centers from underdeveloped countries are also adopting these servers as they are available at affordable price points.”