Analyzing purchasing channels for cabling products

Survey reveals preferences and habits among those purchasing cabling products through distribution, directly from manufacturers, and through online commerce sites.

By Patrick McLaughlin

Results of a survey recently conducted by Cabling Installation & Maintenance reveal purchasing preferences and habits of professionals who buy and use cabling and cabling-related products. The survey focused on the sales channels through which products areacquired.

Conducted in January 2018, the survey gathered results from 1026 professionals who categorized themselves as cabling system designers, installers or integrators; individuals within end-user organizations who manage network cabling systems; or consultants who specify and/or solicit bids for cabling projects. More than 75 percent of respondents work in North America; other geographic regions represented include Mexico and Central/Latin America, South America, Europe-Middle East-Africa, and Asia/Pacific.

We asked participants to share information from their purchasing experiences over the previous two years. The survey did not ask participants to identify the specific dollar value of products purchased in that two-year timeframe; however, we did ask a series of questions about the channels through which products are purchased, based on dollar value. Specifically, we asked: In the past two years, what percentage of your purchases of cabling and cabling-related products have you made A) direct from product manufacturers; B) through cabling distributors; and C) through online commerce providers not directly associated with the cabling industry. These were posed as three separate questions, and respondents were asked to specify a number between 0 and 100 percent, for each question, based on dollar value rather than on unitspurchased.

Popularity of online commerce sites

Because we did not ask respondents to specify their actual spends over the past two years, the responses to these questions do not reflect dollar totals; rather, they better reflect a general frequency with which respondents purchase through each channel. To that end, “direct from product manufacturers” yielded a 24.4 percent response; “through cabling distributors” yielded 59.6 percent; and “through online commerce providers not directly associated with the cabling industry” yielded 16percent.

We dove a little deeper into the purchasing habits of those who have bought through non-industry-related online commerce sites to determine the products most commonly bought through this medium. They are, in descending order: 5) patch panels (purchased by 40 percent of those who have used online commerce sites); 4) twisted-pair copper cable (by 42 percent of purchasers) 2) (it’s a tie for second place between …) cable ties and RJ45 plugs/jacks (by 55 percent of purchasers); 1) patch cords (by 57 percent of purchasers). The other products most commonly purchased via online commerce sites are wireless access points (39 percent), cable management devices (38 percent), copper installation tools (37 percent), cable support devices like J-hooks and similar devices (37 percent), coaxial plugs and jacks (35 percent), media converters (35 percent), tone generators/probes (34 percent), racks and cabinets (34 percent), and copper-cable continuity testers (33 percent). Other products we asked about were chosen by fewer than 33 percent of those professionals who purchased cabling products through non-industry-associated online commerce sites within the past twoyears.

Services from distributors

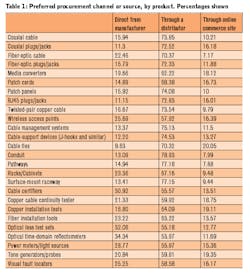

Among the three sales channels we examined (distributors, direct from manufacturers, online commerce), distributors ranked as the preferred source for all 26 product types we inquired about (see details in the nearby table). For most of the products, purchasing direct from manufacturers was the second-most-popular choice over purchasing via onlinecommerce.

More than two out of three—69 percent—of survey respondents stated they are able to procure all the products they need for a project through a single distributor always, virtually always, or most of the time. The remaining 31 percent indicated they sometimes, rarely, or never are able to procure all needed products from a single distributor. Nonetheless, loyalty to a single distributor is uncommon. Only 7 percent said they have used just one distributor over the past two years. Twenty-seven percent have used two and 30 percent have used three distributors within that time frame. While 3 percent said they have not used any distributors, 33 percent have purchased from four or more distributors over the most recent 24-monthperiod.

Not surprisingly, competitive pricing outranked every other distributor factor in importance; 94.3 percent of respondents said competitive pricing is an “important” or a “very important” service offering from distributors. Also ranking highly in importance are technical product support (80.4 percent), pre-sale support (76.5 percent), the ability for the purchaser to view up-to-date stock status online (66.8 percent), and the ability to offer guidance on compliance with regional, state, or national codes and laws (65.7percent).

Manufacturer-distributor interplay

Some data provides a window into the interplay between product manufacturers and distributors as purchasers of cabling products and systems prepare for projects. For example, as just noted, 80.4 percent of respondents indicated that technical product support is an important or very important service offering from a distributor. Survey data also shows that 73 percent of respondents find manufacturers to be better sources of technical information than distributors are. That data point does not strike this author as particularly surprising, considering the likelihood that much of the technical information sought is product-specific. Nonetheless, another data point from the survey shows that 68 percent of purchasers are either highly or moderately influenced by a distributor’s recommendation of aproduct.

A question posed later in the survey may shed some light on professionals’ preference for distributors as their sources for products and systems. We asked: “Please indicate which conditions you’d be willing to trade-off or accept to procure cabling products or systems directly from the manufacturer at a lower cost than the cost available through a distributor.” None of the options we asked about ranked highly. The conditions are listed immediately below, with the percentage of respondents who answered affirmatively that they’d beacceptable.

• The trials and tribulations of dealing with multiple manufacturers on a given project: 45percent

• Longer lead time, within reason: 39percent

• Relying only on manufacturers for technical and project support: 39percent

• Registering the product or system with the manufacturer: 37percent

• Unpredictable delivery dates: 18percent

Expanding on one of the options in that question, we inquired about professionals registering the products they purchase with the manufacturers of those products. Sixty-seven percent typically do register products with the manufacturers. When asked to specify the benefits they value in exchange for certifying products, 79.9 percent said they value a warranty, and 72.6 percent said they value technical support. Nearly half—48.6 percent—value detailed documentation in exchange for product registration, and 37.7 percent valuerebates.

From the data we collected and cross-referenced, this author is left with four takeaways about the dynamics of purchasing channels in the cablingindustry.

1. Purchasers value supporting documentation and direct technical support for the purchases theymake.

2. They trust and rely on the technical expertise of manufacturers and distributors—manufacturersparticularly.

3. No entity should assume loyalty; a purchaser is likely to heed a distributor’s product recommendation, and most purchase from three or more distributorsregularly.

4. For some products in particular, non-industry-related online commerce sites are a regular place ofpurchase.

Patrick McLaughlin is our chief editor.

Commentary from industry purchasers

When conducting the survey that produced the data points in this article, we asked respondents a number of “pick-list” type questions. We also gave them the opportunity to provide narrative responses about their experiences purchasing products through different channels. We asked respondents to share any comments they wished to make about the technical information and technical support they receive from manufacturers and distributors. Here is a representative sampling of the responses we received.

“Most do a very good job of giving us the support and help we are seeking.”

“My only issue: Sometimes it takes a while to get back to us with the information we need. They need to realize that often we are in a time crunch, and need the information as quickly as possible.”

“Technical support is key. Every product fails at some point. What I look for is the support, or lack of support, we receive.”

“I appreciate the ability to electronically download as much as possible—spec sheets, manuals, etc. I still prefer print catalogs, but PDF cut sheets are helpful when doing product searches.”

“The easier the information is to grab, the more likely I’d be interested in a product.”

“The ability to source materials alone, without sales assistance or the requirement to log in, is great for me. I typically am involved in quick-turn projects and don’t have the time or patience to wait for quotes or distributor alignments.”

“Clear and correct copies of documentation is critical in making an informed decision about using a product in an installation.”

“Any misinformation in this area can be costly.”-P.M.

About the Author

Patrick McLaughlin

Chief Editor

Patrick McLaughlin, chief editor of Cabling Installation & Maintenance, has covered the cabling industry for more than 20 years. He has authored hundreds of articles on technical and business topics related to the specification, design, installation, and management of information communications technology systems. McLaughlin has presented at live in-person and online events, and he has spearheaded cablinginstall.com's webcast seminar programs for 15 years.