Analyst: 40G transceivers ubiquitous, 100G accelerating in data center optics market

Technology market research firm IHS Infonetics (NYSE: IHS) reports that revenue from 10-, 40- and 100-Gigabit optical transceivers sold into the enterprise and data center markets grew 21 percent in 2014 to $1.4 billion, almost entirely due to increased 40G QSFP (quad small form factor pluggable) spending.

“40G transceivers are ramping up hard as data centers deploy 40GbE, particularly as a high-density 10G interface via breakout cables," reveals Andrew Schmitt, research director for carrier transport networking at IHS Infonetics. "40G QSFP demand growth over single-mode fiber is primarily a result of large shipments to internet content providers Microsoft and Google."

IHS Infonetics’ biannual 10G/40G/100G Data Center Optics market size and forecast report tracks in granular detail optical transceivers, or short reach optics, by speed, reach, wavelength and form factor. According to the report, data center transceivers account for 65 percent of the overall (telecom and datacom) 10G/40G/100G optical transceiver market. Total 40G transceiver revenue grew 81 percent in the second half of 2014 (2H14) over the same period a year ago (2H13).

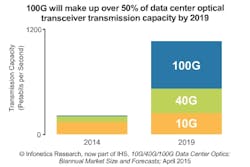

“The market for 100G data center optics is accelerating, but it has yet to be turbocharged by widespread data center deployment in the way 40G QSFP optics have," adds Schmitt. "This will change dramatically in 2016 as cheap 100G silicon reaches production and QSFP28 shipments surge as a result. Next year is going to be huge for 100GbE.”

The report also reveals that 10G shipments in the data center continue to grow at healthy rates, but are being impacted by growth of 40G interfaces used as high-density 10G interfaces. Meanwhile, the report states that worldwide revenue for client 10G modules was flat on a year-over year basis in 2014. Overall, IHS Infonetics expects the datacom optical transceiver market to grow to over $2.1 billion by 2019.