For Ethernet switches, 25/100G surging, 200/400G to make inroads

IHS Markit recently released its “Data Center Network Equipment” market tracker report, which showed that worldwide data center Ethernet switch revenue grew 12 percent YoY in 3Q17, reaching $2.9 billion. Key segments driving market demand, according to the researcher, were purpose-built switches, which grew 13 percent YoY; and bare metal switches, a segment that grew 47 percent YoY and continues to flourish, as customers transition from traditional switches to white box and branded bare metal models.

According to IHS Markit, the number of data center Ethernet switch ports shipped worldwide grew 24 percent YoY in 3Q17, reaching 12.5 million. 25GE and 100GE switch ports experienced significant uptake, notes the analyst, resulting in 251 percent and 369 percent YoY growths, respectively. Yet, these two port speeds combined only to make up 16 percent of ports shipped, while 10GE still leads with 61 percent of ports shipped in 3Q17.

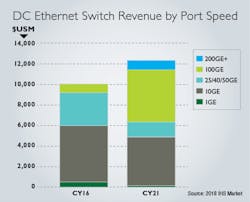

IHS Markit forecasts 25/100GE ports shipped to rise to 46 percent combined, and 10GE to decrease to 46 percent by 2021, as customers migrate from 10GE to 25GE server connections, and 100GE ASPs decline, making them more viable options for large and small cloud service providers (CSPs) to deploy. The continued adoption of 25GE between servers and ToR switches will push adopters of 25GE to upgrade to 100GE for interswitch connectivity, adds the analyst, nothing that this shift is now underway in the enterprise.

“The market for 10GE/40GE has seen a shift with ASPs [average selling prices] falling rapidly; the number of ports shipped is also slowing, with revenue growth of 10GE and 40GE port shipments following unit shipments,” explains the analyst. “CSPs are the earliest adopters of higher speeds and pave the way for use of higher-speed technologies. Large DC cloud environments with high compute utilization requirements continually tax their networking infrastructure, requiring them to adopt high speeds at a fast rate, ultimately resulting in the lowest $/1GE ratios.”

Further up the protocol stack, IHS Markit expects trials for 200/400GE to begin in 2018, with the need for greater than 100GE speeds resulting in production shipments beginning in 2019, with revenues to reach approximately $1 billion by 2021.

“We believe 200GE will be deployed first, yet have a short shelf life, as 400GE is expected to follow closely behind and will become the primary choice going forward,” comments Cliff Grossner, Ph.D., senior research director and advisor for the Cloud and Data Center Research Practice at IHS Markit. He adds, “The gap in time will be solely determined by how long it takes for the higher speed to become production-ready with adequate supply. CSPs will be the main customers for 200/400GE as they transition from 100GE, in an effort to satisfy increasing high-bandwidth demands.”

In terms of vendor performance, according to IHS Markit: “Cisco continues to dominate and Arista is #2 in the DC Ethernet switch market. Cisco garnered 53 percent of DC Ethernet switch market revenue in 3Q17 with revenue up 5 percent YoY. Arista was #2 with 13 percent share and 50 percent YoY growth. Huawei was #3 with 7 percent share and 23 percent YoY growth.”