Analyst: 800G Being Adopted at Nearly 100x the Rate 400G Was

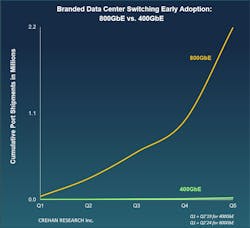

Crehan Research recently reported its findings for Ethernet switch sales in the first half of 2025. The firm’s president Seamus Crehan got right to the point when he said, “Generative AI has dramatically changed the ramps for new higher Ethernet speeds, driving much steeper and faster adoption curves.”

The firm explained, “While demand for general data center compute networking was solid, generative AI was a key growth driver of the strong Ethernet switch results. In correlation with generative AI growth, there was a surge in 800 Gigabit Ethernet (GbE) switch deployments, whose adoption is turning out to be much faster than that of 400 GbE. This is especially true for branded 800 GbE data center switching with an adoption curve, to date, that is almost 100 times better than that of 400 GbE.”

For the overall Ethernet switch market, both revenue and shipments grew more than 25% compared to the first half of 2024.

“The networking of large generative AI cluster buildouts is driving some dramatic quarter-to-quarter market-share shifts in the highest speeds of the data center Ethernet switch market,” Seamus Crehan added.

The firm’s announcement of the first half results included the following details on branded switches.

- Arista’s 800 GbE shipments neared a 3-million port annualized run rate in the second quarter of 2025, which is that company’s quickest-ever timeframe to approach this quarterly amount with a new Ethernet speed. Arista took the top market-share position in the 800 GbE branded data center switch segment.

- H3C’s 400 GbE shipments more than doubled, year-over-year, in the second quarter to surpass 1 million ports in the quarter. Strong hyperscaler demand from China drove the growth, and H3C currently has the second-largest market share in branded data center 400 GbE switch shipments.

- Huawei’s data center Ethernet switch revenue nearly doubled sequentially, on the strength of AI network deployments. Huawei’s switches are part of its recently introduced CloudMatrix 384 AI system.

You can find out more about Crehan Research and its 1H 2025 findings here.