ICT industry not dealing with The Great Resignation but rather, The Great Retirement

In 2021, total average compensation for workers in the information and communications technology (ICT) industry was down 3.6% compared to compensation in 2021. In an era that has become known as The Great Resignation, the norm in this employees’ market is for employers to increase compensation in an attempt to attract talent. Why then, in this employment climate, would compensation decline rather than rise from one year to the next?

Statistics gathered in our fourth annual survey of compensation in the ICT industry—which is a collaborative effort between Cabling Installation & Maintenance and Fluke Networks, and which is powered by BICSI—point to three factors that depressed compensation in 2021: 1) inflation was considered transitory until late 2021 and did not show up in last year’s paychecks; 2) overtime and bonus pay reduced sharply from 2020; and 3) more-experienced and higher-paid workers left the workforce, driving down the mean compensation among the workforce as a whole.

The Great Retirement

While the inflation rate rose to 7% by the end of 2021, it began the year below 2%. Employers establishing pay rates for 2021 at the beginning of the year or in late 2020 did not account for significant inflation, if they accounted for any at all.

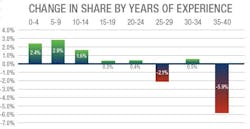

The shifting age demographic of our survey participants tells its own story, and is likely to have long-term impacts on the ICT industry. The average age of our survey respondents dropped by 3 years, from 51 to 48. The share of participants with 0 to 4 years of experience, 5 to 9 years of experience, and 10 to 14 years of experience in the ICT industry grew 2.4%, 2.9%, and 1.6% respectively. The share of participants with 25 to 29 years of experience and with 35 to 40 years of experience declined by 2.1% and 5.9% respectively. The share of survey participants with 15 to 19 years, 20 to 24 years, and 30 to 34 years of experience remained essentially flat—each growing by 0.5% or less. Interestingly, the average total compensation of workers with 0 to 24 years of ICT industry experience grew by 5% to $87,214, while the average total comp of those with 25 or more years of experience declined by 4%, to $105,565.

When we chart average compensation by decade-age (20s, 30s, 40s, etc.), a tailoff becomes evident. Using the average compensation of a worker in their 20s as a baseline of 100%, workers in their 30s earn 113% of that baseline; workers in their 40s earn 120%; and workers in their 50s earn 128%. But compensation recedes to 117% for workers in their 60s.

Switching to compensation by years of experience, in 5-year intervals, we use the newest workers with 0 to 4 years of experience as the baseline 100%. Workers with 5 to 9 years of experience earn 104%; 10 to 14 years, 107%; 15 to 19 years, 115%; 20 to 24 years, 134%; 25 to 29 years, 131%, 30 to 34 years, 144%; 35 to 40 years, 128%.

Methodology and results

We collected the data discussed in this article via online survey. Invitations to participate in the survey were sent and data was collected in late 2021. The survey reached professionals inside and outside the United States, but we collected information only from individuals working in the U.S. We obtained a total of 571 usable responses.

Participants’ job types break down as follows: 69 designers, 95 engineers, 78 general managers, 130 lead technicians, 91 project managers, 56 technicians, and 48 in the category “other.” The average annual compensation for each job type is: designer, $105,646; engineer, $113,478; general manager, $110,055; lead technician, $78,210; project manager, $94,797; technician, $67,818; other, $106,927. Among salaried employees in the “other” category, the top-paying role is network/IT management and support, with an average salary of $115,745.

The expertise advantage

Self-declared experts in all technology types we asked about earned higher-than-average compensation. Workers with expertise in the Internet of Things earned 16% higher compensation than average, while experts in data center installations, security, and industrial automation all earned 11% above average. Outside-plant and wireless-systems experts earned 6%-higher-than-average compensation, while fiber-optics experts earned 5% higher than average.

The industries in which ICT workers ply their trade appears to affect compensation. We asked respondents if they work in the following sectors: colleges and universities, commercial office buildings, data centers, financial institutions, government, healthcare, industrial/manufacturing, K-12, residential. We then compared the compensation of those working in each of these industries with overall average compensation. Please bear in mind that some respondents are employed by end-user organizations in these sectors, while other respondents work for contracting organizations, for whom these sectors represent customers.

For professionals who work in the colleges and universities sector, their compensation was neither higher nor lower, overall, than the industry average. Three sectors represent slightly lower-than-average compensation: industrial/manufacturing (-1%), K-12 (-2%), and residential (-2%). The others represent higher-than-average compensation levels among workers, as follows: commercial office buildings, +4%; financial institutions, +6%; healthcare, +9%; data centers, +10%; government, +13%.

Gender, certifications, and more

Women represented 9% of participants, which is the highest percentage in the survey’s four years and up from 4% a year ago. General management, technician, and designer were the most popular job types among women.

As has consistently been the case each year of the survey, professionals holding BICSI’s Registered Communications Distribution Designer (RCDD) earned higher compensation than those not holding that credential. In 2021, RCDDs earned 17% higher compensation than ICT professionals without that designation.

The percentage of workers who are members of unions or labor guilds has dropped slightly over the past few years, from 14% in 2019 to 12% in 2021. Overall, union members earn 11% more than non-union members, but the disparity varies by job type. For example, union engineers actually earn 4% less than non-union engineers. But for all other job types, union membership means higher compensation, as follows: technician, +7%, designer, +9%, project manager, +13%, lead technician, +18%, general management, +29%.

A potentially surprising data set from 2021 used a high-school education as a baseline of 100%, and showed that being educated at a technical/trade/vocational school correlated to slightly less (-2%) compensation compared to that high-school education. In our top-layer analysis of these results, we have not yet mined the data to cross-reference years of experience with these education levels. It could turn out that deeply experienced professionals with high-school diplomas drive up the average compensation for that education level, while graduates of technical/trade/vocational schools are, on the whole, less experienced in the industry. That possibility is strictly conjecture as we continue to peel back layers of data from the survey.

Finally, the ICT industry does show some characteristics of The Great Resignation, particularly when some 2021 data is compared to 2020’s. In 2021, 10% of workers changed employers, barely increasing over the 9% who changed employers in 2020. The difference, however, was those who changed jobs in 2021 reported making 2% more than those who did not change jobs that year. Contrast that with 2020, when those changing jobs made 6% less than those who did not. We surmised then, and still believe, that many job changes in 2020 were involuntary through layoff or extended furlough. Additionally, in 2021 10% of workers reported changing jobs while staying with their same employer. In 2020, only 3% made that type of internal move. We do not have data on the specifics of the internal job changes these 10% made in 2021, but it stands to reason that promotions within the employer organization represent some of that movement.

We at Cabling Installation & Maintenance and Fluke Networks, along with our supporting partner BICSI, look forward to further examining and detailing the data from our most recent survey. Look for documents and presentations from us in the months ahead.

Patrick McLaughlin is our chief editor.

About the Author

Patrick McLaughlin

Chief Editor

Patrick McLaughlin, chief editor of Cabling Installation & Maintenance, has covered the cabling industry for more than 20 years. He has authored hundreds of articles on technical and business topics related to the specification, design, installation, and management of information communications technology systems. McLaughlin has presented at live in-person and online events, and he has spearheaded cablinginstall.com's webcast seminar programs for 15 years.