Biometrics open door to Ethernet-capable solutions

New cabling schemes are accommodating emerging access control technology.

Biometrics technology, a way for government, public and private organizations to secure and control physical access to their buildings, has evolved dramatically in the past year. With this evolution has come new challenges for cabling contractors who are faced with installing biometric equipment efficiently and economically.

Electronic access control permits entrance by scanning a person's physical characteristics. In every biometric application, a template or code is created based on an individual's unique biometric characteristics.

A new way of 'seeing'

Hand geometry, which measures characteristics such as the curves of fingers, has been implemented for low, medium, and high-security access control. Fingerprinting has been around for more than a century, and is widely used and accepted. Iris recognition is especially suited for high-security locations. Face recognition and behavioral technologies (voice authentication and signature verification, for example) are also gaining acceptance in the security industry. Signature verification not only takes into account what a signature looks like, but it analyzes the shape, speed, stroke, pressure, and timing during the act.

In the past, geometric readers required a separate communication link. Now the technology has evolved to the point where it provides a more seamless linking of communications between biometric human interface devices and the intelligent controller, which, for example, is the access control device that makes decisions on whether an individual can gain access to a building or keyboard.

Biometric technology users increasingly want products that offer higher security, quality and robustness. The technology, in response, is graduating to Ethernet and wireless compatibility.

Among the latest developments:

- Cross Match Technologies Inc. (Palm Beach Garden, FL; www.crossmatch.com), has expanded its LiveScan products, which are the electronic equivalent of ink and paper fingerprint cards. LiveScan systems have evolved from stand-alone capture devices to complex systems with integration to multiple databases.

- BioPay LLC (Herndon, VA; www.biopay.com,) has Paycheck Secure, which enables a person to use their checking account through a fingerprinting device.

- Recognition Systems (Campbell, CA; www.rsibiometrics.com) fingerprint readers analyze fingerprints located between the tip of a finger and first knuckle. The readers capture an image by a patented algorithm, which then extracts points from the image and converts the data into a mathematical template.

- DigitalPersona Inc. (Redwood City, CA; www.digitalpersona.com), makes DigitalPersona Pro, a fingerprint-based password automation solution for computers.

More advanced technology is on the way. George Seamon, chief executive officer for the installation company Applied Network Concepts Inc. (Lisle, IL; www.

anetconcepts.com), believes that during the next five to 10 years manufacturers will offer a cost-effective system that will enable facial and geometric verification from a localized camera, allowing a person to gain entry to a facility without having to stop.

But for now, some cabling contractors say they are seeing their biometric-based installation costs drop as manufacturing practices become more streamlined. "With the communication between biometric producers and access control producers getting better, the installation costs will be less and they will be easier to install," says Terry Kauthe, chief technical officer for Applied Network Concepts. "Now you don't need to run an extra [communications] line for biometrics, and can use the standard output or input to an access control panel, which will further reduce the cost of the installation."

Hot fingers

Although the biometric market is in a state of flux, some analysts insist that demand is growing. According to the International Biometric Group (New York City, www.biometricgroup.com), the projected total revenue for the entire industry this year is $1.2 billion. The market is expected to reach $1.8 billion in 2005. By far, the hottest biometric technology is fingerprinting, which is seeing sales to the tune of $367 million. The second most popular biometric product is face recognition equipment at $114.2 million, followed by hand geometry equipment at $87.9 million.

Amanda Goltz, a consultant for International Biometric Group, says these inroads seem small, even though the industry saw a spike in interest after 9/11. But that interest did not translate to immediate sales. "It took awhile for private firms to sit back and figure out what they wanted to do, and what types of devices they would purchase," says Goltz. "Now we are starting to see the leading edge of a huge flow of money into the market."

The revived "beginnings" of investment in biometrics are coming largely from the public sector, such as airports. The private sector, however, is warming to the idea more slowly. But that is changing, too, as institutions such as banks consider biometrics for entrances to vaults or other areas. "This is new technology, and there is always a hesitance; no one wants to be the first out of the gate to fail big," says Goltz.

One reason for caution is that biometric technology requires considerable investment in product hardware and software. And once equipment is installed, it must be maintained, and employees must be trained. There is also concern about privacy, and how employees would react to having physical attributes of their body recorded.

But tumbling costs, necessity, and partnerships are all helping to bring biometrics to widespread reality. Costs are coming down—a significant change, since biometrics have been mostly employed by larger institutions, such as nuclear power plants, Department of Defense operations, or larger corporations.

Growth opportunity

And as biometrics have become more a part of national security programs, end users small and large are becoming less intimidated by the technology, and smaller end users who at one time decided not to spend the $3,000 to $5,000 for an access control system are spending $1,000 for a hand geometry reader or $800 for a fingerprint reader.

Biometric devices from Recognition Systems are now being used at the front doors of college sorority houses, and at recreation and fitness centers. "We are beginning to see some customers that we never expected to see," says Bill Spence, director of marketing.

Tom Buss, senior vice president of engineering and operations for Cross Match Technologies, agrees that dollars for the products' installation have been released in the past year. "It's starting to finally happen," says Buss. "People are beginning to learn what works, and what doesn't, and that there is technology out there that has lowered in cost."

BioPay, for example, which released its first biometric product in 2000, made $1 million in initial sales and had 100,000 users by 2003. But today, says BioPay communications manager Robyn Porter, more than one million end users are using the fingerprinting device. "It took us a long time to get over the first hurdle, but there is a need, and consumers are joining the bandwagon," says Porter.

Partnerships are also expanding. Microsoft Corp. (Redmond, WA, www.microsoft.com), for example, has chosen to use DigitalPersona Inc.'s products. "This says that this technology is moving from a niche to something adopted in a mainstream fashion," says Vance Bjorn, CTO for DigitalPersona.

Some forms of biometrics, such as voice recognition, are proving that they have potential growth for installers because they can be used with existing technology, including plain old telephone systems, cell phones and Voice over Internet Protocol (VoIP). Spence says Recognition Systems is seeing success in sales of its fingerprinting devices for enterprise end user applications; for example, to allow access to the entrance to a small company's telecom room. Hand geometry, in comparison, tends to be used for larger operations, such as for entrance to a nuclear power plant or large corporate environments.

As biometrics technology grows, users are realizing that support and longevity are a critical factor in selecting a particular device. "We see much smarter customers realizing the importance of support, and the importance of that company being around for a while," says Spence. "They are asking, 'Will I get replacement parts for this product? Will my warranty be held up?'"

New cabling schemes

With the technology's growth has come changes in installation schemes. "Most [biometric] cable installation is pretty much the same thing," says Kauthe of Applied Network Concepts. "You deal with wire management, know approximately how many cables you can pull, and what the characteristics are of the cable."

But contractors say new wiring schemes are becoming more important for biometrics installers. "People are beginning to put a lot of emphasis on installation and networking them together," says Spence. "It could be because of Ethernet, bringing multiple doors together and linking those doors."

Contractors, for example, are pulling cable from a network's backbone to communicate with biometric readers, and are installing more single-door controllers for each door in a multiple-doors network that's connected by data cabling. "Using a single-door controller will increase the flexibility and further distribute the data," says Spence. "This creates a robust system where if you have eight doors to a panel, if one panel goes down, you won't have a problem with the other seven. This provides more intelligence at one door, and it calls for different wiring requirements for those different products."

Some contractors are noticing that the latest biometrics products are requiring a lot more cabling than before. Installers from Cross Match Technologies, which installs access control systems, say the increased demand for Ethernet-based products is calling for Ethernet-capable cabling. Physical access control devices, which once depended on a Wiegand interface (standard across control systems) are now moving toward Ethernet-based solutions. "The advantage of Ethernet is it's faster, and it's got tremendous bandwidth," says Buss.

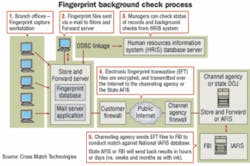

Cross Match's LiveScan refers to the process of capturing fingerprints directly into a digitized format as opposed to traditional ink and paper methods. Fingerprints from job applicants are captured on 10-print "live scan" fingerprint systems in branch offices, and sent electronically to a customer store and forward system to queue up and send on to an FBI-approved industry channeling agency, such as the American Bankers Association or a State Department of Justice. The LiveScan system software integrates with existing records management systems, such as a Human Resources Information System (HRIS) for ease of moving demographic data from one system to the other.

If Ethernet-ready cabling is not already present, it must be pulled in—and lots of it—to serve the latest biometric devices. "The difference is, we now have to run an Ethernet connection between our readers and matchbox, with a matching accelerator and database; so, there is a lot more cabling to be pulled in for our system," says Buss.

"More and more end users are using Ethernet to network these products together," agrees Spence. "We are used to looking at twisted pair or shielded twisted pair for this, but we are seeing Ethernet becoming a reasonable option as the prices come down."

Seamon of Applied Network Concepts says that a little more than a year ago, a typical major biometrics installation could take up to eight months to complete. This included approximately two and a half months devoted to pulling in composite cable—a specially-made, bundled media that has specified cables to match the protocols and power requirements of the biometric devices being installed. But now, Seamon says, installation time is much faster.

When pulling cables for biometerics devices, Kauthe says, cable identification is crucial. When labeling, he says the contractor must identify the device, its location, the panel to which it will be pulled, and the port to which it will be connected. "It's basic wire management," says Kauthe. "You do one thing, complete it, and then go on to the next and pull as much cable as you can. The key is labeling."

BRIAN MILLIGAN is senior editor for Cabling Installation & Maintenance.