Cabling industry to continue steady growth

Research indicates that growth is set to continue well into the next decade

Patrick McLaughlin

The North American structured cabling industry`s market growth is poised to continue at a steady pace through the first half of the next decade, according to numbers presented at the Structured Cabling Marketplace (SCM) seminar in Atlanta in late October. The seminar was a platform in which technical and research firms presented information on the current state of the entire marketplace and detailed what will drive the industry`s growth in the next several years.

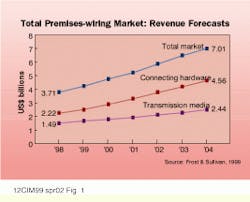

In her presentation on copper and fiber`s race for supremacy in horizontal cabling runs, Catherine Bouchard, an analyst with Frost & Sullivan (Mountain View, CA), projected that the total market--including media and hardware--will nearly double, from $3.71 billion in 1998 to $7.01 billion in 2004. Specifically, she predicted that cabling media would grow about 64%, from $1.49 billion in 1998 to $2.44 billion in 2004, with hardware making up the difference in those market figures.

That market growth will persist despite the several challenges present in the industry, Bouchard explained. For example, product prices are in a downward spiral. Fiber-cabling manufacturers lowered their prices to make them cost-competitive with copper-based products, which prompted many copper-cabling manufacturers to lower their prices to maintain a cost gap between the two media types. Other challenges facing manufacturers in the marketplace include slow standardization efforts, slow adoption of bandwidth-intensive applications, and the threat of raw-material shortages.

Obviously, the anticipated growth indicates that market drivers will outweigh the challenges. Bouchard described some of those drivers in her presentation. For example, the large installed base of cabling products ensures product-replacement revenues; enhanced products with superior performance and features are becoming popular; and wiring-hardware technologies continue to improve.

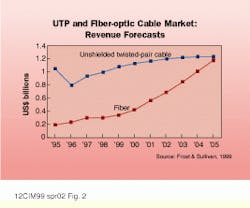

Media types square off

The battle in media types is still between copper and fiber, and Bouchard indicated that the fiber-cable market will grow more rapidly than the copper-cable market through 2005. This year, the copper-cable market will be approximately $1.1 billion and the fiber-cable market approximately $350 million. In 2005, she predicts, copper will still lead fiber, but only by the slimmest of margins. Copper cables will pass $1.2 billion that year, and fiber cables will fall slightly short of the $1.2-billion mark.

Bouchard said that the combination of shielded and screened twisted-pair, coaxial, and hybrid copper/fiber-cable markets will actually fall in that same time frame. She projects the combined market to be $199.7 million in 1999, but only $180.8 million in 2005. She made this projection despite acknowledging the impending emergence of a Category 7 shielded twisted-pair standard. Presumably, Frost & Sullivan projects that the Category 7 standard will minimally impact the North American market.

Stephen Montgomery, president of market researcher ElectroniCast Corp. (San Mateo, CA), offered information that supports Frost & Sullivan`s projections about fiber creeping in on copper as a specified medium. He offered some evidence to support that claim, saying that within communications networks, individual terminals are increasingly more powerful. Furthermore, the increasing input and output at each node, multiplied by the continually increasing complexity of data networks, is producing high data rates that the network channels must accommodate. Finally, networks are being interconnected at increasingly large distances--often in excess of 500 meters. Those factors all point to fiber as the medium of choice, Montgomery said.

Residential a growing segment

Contributing to the overall growth of the cabling market is a dynamic and emerging segment--residential cabling. During the SCM seminar, Brian Hills, director of technical services of the Broadband Group (Tucson, AZ), presented both technical and market-projection information on this hot topic.

The Broadband Group, which is not a market forecaster, works with residential developers, getting those developers to incorporate structured cabling systems into the homes they build. Hills specializes in drafting, implementing, and testing all structured wiring guidelines in the Broadband Group communities.

He cited numbers supplied by researchers in his presentation, including one projection which stated that by the end of next year, 55 million U.S. households will be work-at-home households. That number is up from 34.7 million homes in 1997. Additionally, Hills presented numbers showing that by 2002, 67% of U.S. households will have at least one personal computer and 29% of all U.S. homes will have more than one PC.

The increased use of PCs inside homes is contributing to the growing need for homes to be equipped with a network infrastructure. Other drivers feeding this need are the demand for entertainment services via cable television and satellite, as well as home-automation services. Thanks to these drivers, it is estimated that 2.5 million homes will be wired by 2004.

Hills also presented revenue projections for the home-wiring market, which is expected to grow from $195 million this year to $579 million in 2002.

In addition to presenting research data on the need for wired homes, Hills provided insight into the benefits of having a wired residence. Among those benefits are the assurance of resale value, the ability to work in a functional home office, and access to entertainment services.

He summarized his presentation by stating, "Advancements in the mass adoption of home technologies such as computers, software, and high-speed Internet access provide the foundation that will facilitate substantive changes in consumer demand and subsequently how builders provision the homes they build. These trends have created both a critical and compelling opportunity for developers and builders to implement a strong technology component in new communities across the country, with residential structured wiring systems as the foundation. Consumers living within these communities will desire homes ready to accept new technologies and services as they emerge, providing an increased level of installation of base structured wiring systems, as well as an increase in the purchase of options and upgrades for these systems."

Lending support

In her presentation on voice and video technologies that create cabling challenges, Kathryn Korostoff, president of Sage Research (Natick, MA), lent some support to the prospect that residential cabling is a quickly growing market segment. During the portion of her presentation that focused on videoconferencing, she stated that some of the end-user organizations making up the subject of her research have installed videoconferencing equipment in the residences of work-at-home employees.

The reasons that organizations establish work-at-home employees are various, and Korostoff specifically pointed to real estate prices in her presentation. In the Chicago area, she noted, it can be more economical for organizations to set up home networks for employees than to lease additional office space. Other considerations can include automobile traffic, particularly in congested areas where a single backup can delay the arrival of thousands of workers. For these and other reasons, home offices are emerging as an economical option for employers.

These projections, which track the North American premises-wiring market through 2004, anticipate the hardware market growing more than 100% between 1998 and 2004 and the media market growing approximately 64% in the same time.

Frost & Sullivan predicts fiber media will grow at a sharper rate than copper media and that by 2005, the two types will be nearly equal in revenue.

Maaskant stresses long-term manufacturer/end-user relationship

Keynoting the Structured Cabling Marketplace seminar in late October was Barbara Maaskant, executive director of information services at the Roberto C. Goizueta Business School at Emory University in Atlanta. Her dynamic presentation detailed the business school`s cabling system, the installation of which was featured in the May 1998 issue of Cabling Installation & Maintenance (see "Wiring Emory U. for the 21st century").

In the presentation, she detailed the school`s information-technology (IT) infrastructure costs and pointed out that they totaled approximately 8% of the total building cost. She also compared that 8% figure to the IT-infrastructure expenditures of other business schools.

Maaskant closed with comments specifically to manufacturers in the cabling industry, reminding them not to underestimate their value, particularly in helping organizations like hers make informed decisions. She also stressed the import-ance of product warranties and backward-compatibility and said she sees the relationship between manufacturer and end user as being long-term.