An imminent hazardous substances directive affecting manufacturing, product performance, and economics could be just the tip of the iceberg.

If you’ve heard of RoHS, or perhaps already noticed the acronym printed on network equipment, cables, or labels, you may be wondering what exactly it means for your business, or for the cabling industry as a whole.

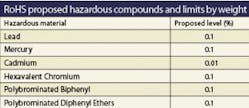

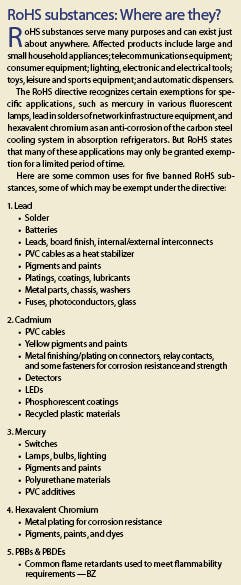

RoHS-Restriction of Hazardous Substances-is a European Union (EU) directive (2002/95/EC) that bans new electrical and electronic equipment entering the European market from containing more than specified levels of hazardous substances. The directive goes into effect July 1 and includes proposed levels for lead, cadmium, mercury, hexavalent chromium, polybrominated biphenyl (PBB), and polybrominated diphenyl ether (PBDE) substances.

While the networking industry in Europe prepares for this summer’s deadline to comply with the RoHS environmental initiative, closer to home, cabling vendors that supply products globally will face potential changes in manufacturing processes, product performance, and economic implications.

As environmental regulations modeled after RoHS take shape in the United States and throughout the world, the entire electronics industry may eventually have to revamp to go ‘green.’

A logistical nightmare

The RoHS directive’s intent is to protect public health by minimizing the impact that electrical and electronic equipment have on the environment, especially when they become waste. RoHS, therefore, identifies and reduces levels of hazardous compounds in the equipment, based on global research and scientific evidence.

With few exceptions, no electrical or electronic equipment can be sold in Europe after July 1 if it is not compliant with the RoHS directive. Equipment vendors that supply products globally do not know where a particular piece of equipment will be sold and, therefore, most will not produce separate product lines of compliant and noncompliant products.

The RoHS directive currently states that if a piece of equipment can be broken down into subcomponents, those subcomponents must also be compliant. Unquestionably, common subcomponents of electrical and electronic equipment are cable and connectors.

“RoHS goes down to the subassembly level; if you supply products that are subassemblies of other products, such as a wire harness used in a piece of equipment, the supplier of the equipment may have to comply-and so do you,” says Perry Marteny, director of research and development at General Cable (www.generalcable.com).

U.S. cabling manufacturers are being bombarded daily with RoHS concerns. “Global customers that use our products in their equipment are requesting the compliance position of each hazardous substance for every part number they purchase, and replying to these requests involves massive database management and administration,” says Mark Bradley, product manager of flame-retardant cable at Corning Cable Systems (www.corningcablesystems.com). “We’ve been told that if we are not compliant, these customers will go elsewhere.”

Because RoHS does not entirely address reporting methods, customer requests come in a variety of nonstandard questions and forms, adding anguish to the task of replying. “We received surveys asking about the six banned substances under RoHS, and then we started getting additional requests asking about another 50 to 100 chemicals,” says George Melnik, general manager at Quabbin Wire and Cable (www.quabbin.com). “It would be a breeze if we only had to deal with the original six, but this initiative is growing way beyond the definition of RoHS.”

Getting the lead out

Some cables have always been RoHS-compliant, but others must be tackled head on by cabling manufacturers. “When the requests come in, we first determine if the hazardous substances exist in a component of the cable and if any exceed the limits of RoHS,” says David Hall, marketing manager for private networks at Corning Cable Systems. “We then have to develop a substitution plan for replacing a hazardous substance with a compliant material.”

Despite chemical companies touting replacements for lead and other hazardous substances, substituting certain compounds in cable to meet the RoHS directive isn’t as simple as it sounds.

“When manufacturing cable, we get comfortable with one raw material and we know from experience how it reacts,” says Corning’s Bradley. “Anytime we make a change, we risk upsetting the balance. Ideally, we’d like to substitute a material, put it through testing, and have it pass. But if it doesn’t pass, then we have to look at redesigning the cable in other areas, which can become very involved and require extensive testing.”

Cabling manufacturers agree that recertifying redesigned RoHS-compliant cable to achieve flame ratings and other specifications is the biggest challenge and expense in meeting the directive. While PBB and PBDE fire retardants will need to be replaced for some cables, replacing lead with an adequate substitution is particularly challenging. Lead extends the thermal aging and temperature rating, and it stabilizes many factors, such as color retention.

“Taking the lead out can be very complicated,” says General Cable’s Marteny. “It can potentially change the density of a compound and affect tensile properties and processing characteristics, possibly causing melt fracture at certain rates of extrusion. Potentially, that could require retooling, slowing down the processing, or developing extrusion dies designed to handle the new replacement substances.”

Customers have relied on lead for several decades to enable appropriate thermal aging properties and other characteristics, and experience tells them it works. “Lead makes many things controllable and predictable, and it has long-term data behind it,” says Quabbin’s Melnik. “Although replacement substances meet specifications today, we won’t know if they are truly as good for many years to come.”

The costs of R&D, administration, manufacturing, new compounds, and retesting involved in responding to the RoHS initiative add up for cabling manufacturers. “Not only do we have to make sure we have the technology to meet compliance without giving up performance, but we have to do it within the existing market,” says Marteny. “There is a cost in meeting the RoHS initiative, but it is unilateral-the market will share that cost as the cabling manufacturers and OEMs look to recover the additional expenditures.”

But some believe that the cost increase for the consumer will likely be negligible. “When RoHS was first developed, there was a predicted cost increase of 20 percent per unit, but that has dropped significantly,” says Melnik. “Two years ago, the chemistry wasn’t there. Now, chemical companies are competing aggressively, and they all have compliant product lines, which drives down the price.”

The conversion question

With the extensive efforts involved in converting to RoHS-compliant products, cabling manufacturers are faced with tough business decisions regarding exactly which cables to convert.

“For products that we sell very few of, there is little motivation for making them RoHS-compliant,” says Marteny. “We focus most of our effort on the bread-and-butter type products; however, we may sell a small amount of one product and a large amount of another to the same customer, and keeping that business could depend on whether the smaller item is compliant. In other words, some customers prefer one-stop shopping.”

Once a specific product is converted, manufacturers are also faced with deciding whether to maintain two versions-one compliant and one not. “If to become RoHS-compliant the cost is significantly increased, it may not make sense to sell a compliant product in a market that doesn’t require it,” explains Marteny. “In that case, we could end up with two versions; however, the trend is moving toward everything being compliant, and in the long run, I think that’s where we’ll end up.”

Meanwhile, Quabbin is taking no chances, and the company says they are nearly complete in converting all of their wire and cable to RoHS compliance. “When selling through distribution, we have no way of knowing what the customer is going to do with a cable,” says Melnik. “Our objective is to make everything compliant so we don’t have to look over our shoulder.”

Various interpretations of the RoHS directive add to the complexity of deciding what to convert and what not to convert. While the directive language clearly states “electric and electronic equipment,” it is difficult to determine where to draw the line. “There is no book that you can look in to find out if a specific cable is impacted by the directive, and that has created a lot of confusion and discussion,” says Corning Cable Systems’ Hall. “The term ‘electronic equipment’ is clear, but then we need to determine compliancy for everything that interacts with that piece of equipment. One could argue that cable in the wall is part of the permanent structure of a building and would, therefore, not have to be compliant.”

While most believe that the term “equipment” does not apply to the cabling in the walls, others believe it does. “We are interpreting the directive as requiring the cabling that connects to a piece of equipment to be compliant,” says Melnik. “Maybe it’s being overly safe, but we believe in making all our cables compliant.”

Snowball effect

Green initiatives cropping up in several U.S. states and throughout the world will also likely impinge on the entire electronics industry in the future. “In essence, the EU has done a lot of the underlying work,” says Marteny. “Much of the research behind RoHS was conducted globally, but the EU has determined how to turn that research into public policy, laying the groundwork that other countries can capitalize on.”

Nearly 30 U.S. states have adopted or have pending legislation with RoHS rules. In 2003, California enacted the Electronics Waste Recycling Act and in 2004 adopted Senate Bill 50, which bans electronic equipment with certain amounts of lead, mercury, cadmium, and hexavalent chromium from being sold in the state as of January 1, 2007. Maine signed a similar law forcing manufacturers to phase out hazardous substances by 2006. Rhode Island, Texas, Washington, and Vermont have similar proposed legislation pending approval.

“RoHS is just the tip of the iceberg, and we could find it snowballing into every state in the U.S.,” says Corning Cable Systems’ Hall. “And governments reserve the right to, and they plan to, add more substances to the list. Everybody will go through this again when those additional materials and levels are established.”

Despite the costs and logistics involved, cabling manufacturers know they cannot ignore RoHS or other emerging green initiatives. “If people are burying their heads in the sand, and hoping that these initiatives will pass them by, they’re fooling themselves,” says Bradley.

Quabbin’s Melnik agrees: “The cost incurred in this process is far less than the cost of noncompliance. If you’re ignoring RoHS, it’s too late. If customers are uneasy about your progress, they will get their RoHS components elsewhere.”

Inventing new technology?

Melnik adds, “It’s very expensive to qualify a vendor, and if you lose a customer because you don’t have RoHS compliant cable yet available, they likely won’t go through the cost of requalifying you when you finally have inventory.” Furthermore, those that try to sell noncompliant products in Europe after the July 1 deadline may be faced with fines, or not being allowed to participate in the market at all.

“In some cases, we are actually inventing new technology,” says Marteny. “In the long run, I believe RoHS will push us toward a better product that removes hazardous materials out of the waste stream. And several years from now, everyone will be better off for it.”BETSY ZIOBRONis a freelance writer and frequent contributor to Cabling Installation & Maintenance. She can be reached at: [email protected]