Forecasters and surveys give reason for optimism

Specific applications likely to drive modest growth of the cabling market.

By an informal consensus, 2005 has been one of mild business growth in the cabling marketplace. Most cabling-system vendors openly state that their business has grown by some single-digit percentage, and nearly all those who speak on the matter believe that, overall, the market for cable and connectivity products has grown by about 5% to 6% this year.

Those numbers, unscientific as they may be, at least are based in fact and historical business activity. What lies ahead for the cabling industry, however, is significantly more difficult to pinpoint. Yet that is the question that, if answered accurately, would guide many of the activities of those vendors serving the cabling trade.

In the cabling industry’s heyday of the mid- to late-1990s, several research organizations produced voluminous reports that detailed the rationale behind the healthy growth they anticipated would continue. Today, fewer of those researchers focus attention on cabling, and those that do continue to study the trends and business, undercurrents that will either spawn more demand for cabling or soften that demand.

Watching closely

The two researchers most closely watching the cabling industry are BSRIA (www.bsria.co.uk) and FTM Consulting (www.ftmconsultinginc.com). BSRIA-Business Services Research Industry Association-is a United Kingdom-based firm that studies structured cabling and several other building systems, including air-conditioning, heating, refrigeration, and plumbing. FTM has focused on the building-cabling marketplace for 10 years.

Both organizations recently released studies sizing up the United States cabling market, and while each has taken a different approach to the research, both see some growth in the immediate future.

In a study of 20 of the world’s largest cabling markets, BSRIA put the U.S.’s figure at $1.4 billion. In its report, BSRIA says that, overall, these 20 markets will grow at an average annual rate of 2.8% between 2004 and 2007. BSRIA points out, however, “mature markets in northern and central Europe, North America, and Australia … are expected to grow only modestly if at all.” (For more detail, see “Strong Asian growth drives global structured cabling,” CI&M, June 2005, page 20.)

Importantly, BSRIA’s $1.4 billion figure represents twisted-pair copper cable, multimode and singlemode optical-fiber cable, outlets, and hardware, including connectors and patch panels, and patch cords. It does not account for cable distribution, routing, and support equipment, such as cable trays, raceways, and other support devices. Nor does it consider test equipment sold into this market. So, it is a fairly safe assumption (though no hard data exists to quantify dollar amounts) that the entirety of the U.S. cabling market far exceeds that $1.4 billion figure.

FTM’s studies offer more-positive predictions about the U.S. market’s future, and some of that firm’s recent reports look at specific applications for cabling. Of particular note is a 2005 study by FTM that predicts 2008 to be the year in which, for the first time, fiber-cable shipments will outpace copper-cable shipments in dollar volume.

FTM President Frank Murawski elaborated on that prediction in this publication (see “Fiber soon to overtake copper in LAN deployments,” CI&M, August 2005, page 72), stating, “This will represent a watershed in the structured cabling systems market. The primary cause for this shift is Gigabit and 10-Gbit Ethernet.” While copper supports Gigabit Ethernet and a 10GBase-T specification is less than a year away, Murawski explains that fiber’s advantage is its ability to support the protocols over long distances. That, he says, will push it past copper in just a few years.

More recently, Murawski gave those in the UTP camp reason for optimism when he said that IP-based video will be a boon to UTP and fiber in premises environments. Fiber will see some growth as a result of IP video’s emergence, Murawski says, but UTP will be the big winner. These types of systems will take market share from conventional analog closed-circuit television (CCTV) systems that run primarily over coaxial cabling. Murawski went into detail on that topic in our November issue (see “Cabling for security applications about to get some structure,” CI&M, November 2005, page 10).

Magazine research

Original research recently conducted by Cabling Installation & Maintenance yielded information from which one may draw similar conclusions. In October, we surveyed 341 cabling-system end users to learn details of their cabling plants’ current situations and projected future needs. Results of the survey indicate that, indeed, 10-Gbit Ethernet and IP-based video will be among the most popularly deployed applications in the next few years.

The survey results provide quantification of the notion that, for many enterprises, security systems and communications/information-technology (IT) systems are converging. Of the 341 surveyed, essentially half (170) are responsible for their organizations’ physical-security infrastructure as well as their telecommunications and data-communications infrastructure. Of that subset, 61.1% are responsible for IP-based or network-based surveillance systems, and 60.7% plan to either implement a new IP/network surveillance system or upgrade an existing one before the end of next year.

By comparison, 48.5% of cabling-system managers who also manage security infrastructure count conventional CCTV systems among their responsibilities. Twenty-seven percent plan to upgrade or install new conventional CCTV systems before the end of 2006-less than half the number planning to deploy IP surveillance in the same time frame.

At least one surveillance-system manager believes the time for IP-based video has arrived. “I work in a 250-bed hospital that is spread out over an area two blocks wide and three blocks long,” explains Jerrold Williams, biomedical supervisor with Muskogee Regional Medical Center in Muskogee, OK. “We have 49 surveillance cameras installed; each and every camera is connected by coax in a home run to the security office. We are adding 85,000 square feet and will require more cameras.”

Williams adds, “The time has come, and indeed it is past, when IP-based surveillance would make such installations much more economical and easier to manage for my facility. I am very much looking forward to changing my surveillance system over to IP-based products.”

10-Gig’s entrance

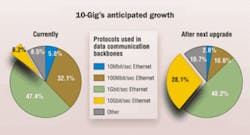

Responses to the survey also suggest that 10-Gbit Ethernet will experience uptake in the years ahead. Currently, 47.4% of respondents run Gigabit Ethernet as their data-communications backbone, and 6.2% run 10-Gbit Ethernet. The current backbone technology for 32.1% is 100-Mbit/sec Fast Ethernet, while 5.8% use 10-Mbit/sec Ethernet.

After those numbers were established, the surveyed end-users were asked which protocols they will deploy after their next major cable-plant upgrade or installation is complete. Gigabit Ethernet will show a slight increase to 48.2%, while 10-Gbit Ethernet will jump to 28.1%. Fast Ethernet will decline more than 20 points to 10.6% and 10-Mbit/sec Ethernet will fall from its already-low number to a mere 2.6%.

The most obvious change in those sets of numbers is 10-Gbit Ethernet’s leap from 6.2% to 28.1%.

At that rate, adoption of 10-Gbit Ethernet backbones would spur increased installation of optical-fiber cable because, while Augmented Category 6 cable is engineered to handle 10-Gbit transmission, it will do so at a maximum distance of 100 meters. Many expect the initial uptake of copper-based 10GBase-T to be in short-run applications (particularly data centers) as opposed to enterprise data-system backbones.

Another factor likely to impact how much, and how quickly, Augmented Category 6 cabling penetrates the market is the TIA’s impending passage of specifications for that performance level. Those specifications officially will arrive in the form of an addendum to the TIA/EIA-568-B standard, and the TIA’s goal is to complete those specifications in the summer of 2006.

Considering the anticipated significant increase in 10-Gbit Ethernet deployment in the future, it is appropriate to contemplate just how far into the future these changes will begin. A total of 39.7% of respondents to our recent survey said they plan to implement a cabling-system upgrade or new installation before the end of 2006. Another 8.8% said they will do so in 2007.

Secure and strong

In addition to surveying cabling-system end users about their anticipated technology needs, Cabling Installation & Maintenance surveyed cabling contractors to gauge their standing on several market trends and business issues. Some data points from that research underscore the aforementioned idea that security systems are a growing niche in this industry.

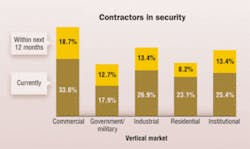

Specifically, contractors were asked about the vertical markets they serve. Here is the list of vertical markets, each followed in parentheses by the percentage of contractors who say they regularly perform security/life-safety installations in that vertical: commercial (33.6), government/military (17.9), industrial (26.9) residential (23.1), and institutional-including health-care, education, and worship facilities (25.4).

A follow-up question asked contractors to indicate those vertical markets they do not currently serve but will devote resources to pursuing within the next 12 months. The results: commercial (18.7), government/military (12.7), industrial (13.4), residential (8.2), institutional (13.4). Both the end-user and contractor surveys offered evidence that wireless networking is a here-and-now rather than an in-the-future technology for some. Eighty-nine percent of contractors have installed some wireless LAN equipment over the past two years. And 15.6% say that more than half of their projects have included wireless LAN equipment installation in that time frame.

From an end-user standpoint, 18.2% say they use wireless data communication in the horizontal portion of their data-communications systems, while 28.1% say that after their next upgrade, wireless will be part of the mix.

Poised for gradual growth

All in all, the cabling industry does not appear to be approaching a time of stagnation but rather, one of gradual growth. Users planning to deploy 10-Gbit Ethernet in their backbones have been able to do so via optical fiber for some time, and research indicates that is exactly the intention of many. The impending passage of the IEEE’s 10GBase-T and the TIA’s Augmented Category 6 specifications will open the door to those with high-throughput needs who will opt for standard-compliant twisted-pair copper infrastructure.

Meanwhile, segments that include security/surveillance systems and wireless technologies seem poised to make a growing impact on the design, installation, and maintenance of enterprise communication systems.

PATRICK McLAUGHLIN is chief editor of Cabling Installation & Maintenance.

A closer look at users with upgrade plans

This article notes that nearly 40% of cabling-system users surveyed indicate they are likely to upgrade their cabling systems or install new systems before the end of 2007.

Following are data points from those users with plans to upgrade their systems within the next 12 months; you may find some points relevant, others perhaps just interesting.

• 6.4% currently have 10-Gbit Ethernet data backbones; 56% have 1-Gbit Ethernet backbones, and 27.5% have 100-Mbit/sec backbones. By the end of next year, 25.7% of them expect to have 10-Gbit in the backbone; 56.9% 1-Gbit; and 11% 100-Mbit. Those figures are similar to the overall market’s expectations, projecting that the universe of 1-Gbit backbones will hold steady while 10-Gbit will rise sharply and 100-Mbit will fall.

• In a “choose-all-that-apply” question, cabling-system users were asked what performance-level unshielded twisted-pair (UTP) cabling they currently run to the desktop. Category 5e rules the day, residing in 80.2% of these end-users’ horizontal systems. Some Category 6 is in the horizontals of just about half (49.5%). Category 5 is the next most-prevalent cabling type, as 36.6% said they have at least some Cat 5 in their systems. And 5.9% of this crowd has some Augmented Category 6 in place.

• 55.1% currently use Power over Ethernet (PoE) technology. An additional 23.9% do not have PoE but plan to make use of it. Of those planning to add PoE capability in the future (regardless of whether they use it currently), half expect to power more than 100 network devices via PoE.

• Nearly one quarter (22.9%) use wireless data connectivity in the horizontal portions of their networks.

• One-in-nine (11%) run gigabit-per-second traffic both in the backbone and to the desk.

• For 77.1%, the cabling system is in multiple buildings that are connected via cabling or wireless technology; 5.5% are in multiple buildings not connected to each other, and 17.4% are contained within a single building.

• In another “choose-all-that-apply” question, two-thirds (67%) say they use UTP in the backbone of their voice communications systems. A total of 40.3% say they use 50-micron multimode fiber, 62.5-micron multimode, or some combination thereof. Of those using UTP, more than half (52.6%) use Category 3 while 46.3% use Category 5e and 32.6% use Category 5. More report using Augmented Category 6 in their voice backbones (3.2%) than report using Category 4 (2.1%). From this data, it is reasonable to conclude that a significant number of voice backbones include multiple cable types with varying capabilities.

• 78% believe that the media they currently deploy in their data-communications backbones can capably handle their next increase in backbone speed, while 9.2% believe their current media will not handle their next speed increase and 11% are not sure. And 1.8% say their next backbone increase is so far off, they are not concerned about it now.

• 9.2% expect to invest more than $1 million in their next major cable-plant upgrade or installation.

• 44% say the top-level executive in their organization is not influential in the planning and decision-making process of their next cabling-system project. Thirty percent say that executive is somewhat influential, and 26% say he or she is very influential.

• Of those with responsibility for their organizations’ security/life-safety systems, 64.7% plan to upgrade or newly implement an IP-based surveillance system before the end of 2006. A little more than one-third-33.8%-plan to upgrade or implement a conventional CCTV system.-PM