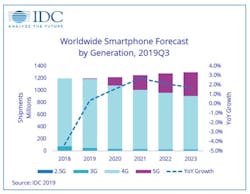

China’s 5G surge will pull smartphone market up in 2020

“Apart from the expected rapid 5G growth in China, we also can’t miss watching other markets such as Australia, Japan, and Korea in Asia/Pacific as well as some European countries that have picked up 5G slower than predicted,” said Sangeetika Srivastava, senior research analyst with IDC’s worldwide mobile device trackers. “Shipments so far in the second half of 2019 have come in much lower than expected and price points are not quite at the premium. Accelerated 5G adoption globally will depend a lot on factors like the arrival of 5G networks, operator support, as well as substantial price reductions to offer more-affordable 5G devices.”

Following three straight years of declining smartphone volumes, there leaves little room for 5G to raise smartphone average selling prices, IDC pointed out. Additionally, the nearly ubiquitous 4G LTE worldwide generally provides users with satisfactory data speeds. IDC expects Android vendors to drive down the cost of 5G smartphones, starting with an abundance of first-quarter announcements. Apple’s entrance into the 5G smartphone market is highly anticipated for a September 2020 announcement, IDC added, with the real focus around pricing and market availability.