Analyst: E-Rate program provides bounce to North American wireless LAN market

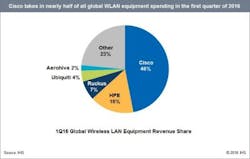

Market research and analyst firm IHS Technology recently released information from its first-quarter 2016 WLAN Equipment and WiFi Phone market tracker service. “Wireless LAN equipment sales totaled $1.2 billion worldwide,” for the quarter ended March 31, the researcher said, “declining 14 percent sequentially due to seasonal demand factors, but continuing on an overall growth trajectory. On a year-over-year basis, revenue is up 5 percent, slightly ahead of 2015’s 4-percent growth rate.”

Among the other highlights in IHS Technology’s analysis, it commented, “Now that the FCC’s new E-Rate program is up and running, WLAN sales to K-12 customers are recovering, and along with it the North American market.”

Otherwise, the analyst’s view of the market includes commoditization, low-cost purchasing, and 802.11ac Wave 2 cannibalizing Wave 1. “Among the good news is further acceleration in access point shipment growth, which stands at 20 percent year-over-year in Q1 2016, with a total of 4.7 million access points shipped,” the company said. “On the other hand, average selling prices haven’t materially increased despite good adoption of 802.11ac and Wave 2 products—the latter standing at 3 percent of all unit shipped in Q1 2016. Demand for WLAN is strong, but monetizing that demand has been a challenge for the last two years as organizations chose lower-cost approaches.”

Nonetheless, IHS says it maintains a bright outlook for the wireless LAN market overall, “as infrastructure investments over the long term shift to WLAN equipment to support the rapid rise of wireless devices, both personal and Internet of Things, as well as mobility requirements.”

The researcher pointed specifically to the following data points from Q1.

- Independent access point shipments continue to post small growth, rising 7 percent year-over-year in the quarter, thanks to demand for low-cost solutions, particularly in Asia-Pacific.

- Commoditization is keeping a lid on independent access point revenue, which declined 8 percent in 2015 and was flat in Q1 2016 from the year-ago quarter.

- More than 70 percent of all access point revenue comes from 802.11ac products, and Wave 2 products broke through the 5-percent market in Q1; Wave 2 products have started to cannibalize Wave 1 802.11ac gear

- The three biggest year-over-year gainers in the wireless LAN market in Q1 2016, in alphabetical order, were Aerohive, Ruckus and Ubiquiti.