Infonetics Research has released its 3rd quarter (3Q13) Wireless LAN Equipment and WiFi Phones report, which tracks access points, WLAN controllers, and Wi-Fi phones for the enterprise. According to the analyst, while worldwide enterprise wireless LAN (WLAN) equipment revenue edged up 1% sequentially in 3Q13, to $1.2 billion, the report reveals that in North America and Asia Pacific, WLAN growth slowed sharply in 3Q13.

“After 15 quarters of double-digit year-over-year growth, WLAN equipment growth fell below the 10% mark in the third quarter of 2013, due to the 802.11n transition nearing completion and 802.11ac not yet having a significant effect on the market,” reveals Matthias Machowinski, directing analyst for enterprise networks and video at Infonetics Research.

The new market report notes that 3Q13 marks the first full quarter in which 802.11ac products were widely available, and 3% of access points sold were based on this new standard. The analysis shows that independent access point revenue is down 40% year-over-year in 3Q13, reflecting the shift toward centrally-managed WLAN.

“Still, we consider this a temporary slowdown and expect growth to reaccelerate in the coming years as buyers focus on their WLAN infrastructure to support the growth of wireless devices and enable BYOD and employee mobility,” Machowinski adds.

See also: TIA white paper addresses wireless spectrum sharing

Meanwhile, despite the slowdown in North America, the EMEA market for wireless equipment is seen doing well, despite relatively weaker economic conditions. Around the industry, number one vendor Cisco’s WLAN revenue share is up a half-point in 3Q13 from 2Q13, and up over 4 points from 3Q12. Also, after a tough couple of years, Wi-Fi phone shipments are growing again on a year-over-year basis, finds the report.

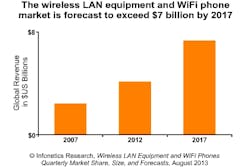

Infonetics’ quarterly WLAN equipment and WiFi phones report provides worldwide and regional market size, vendor market share, forecasts through 2017, analysis, and trends for WLAN infrastructure, including access points by type and technology, WLAN controllers, and enterprise single-mode WiFi phones. Vendors tracked by the report includ Alcatel-Lucent, Aruba, Brocade, Buffalo, Cisco, D-Link, Enterasys, Extreme, Juniper, Meru, Motorola, Netgear, HP, Ruckus, TP-Link, Ubiquiti, Xirrus, others.

About the Author

Matt Vincent

Senior Editor

Matt Vincent is a B2B technology journalist, editor and content producer with over 15 years of experience, specializing in the full range of media content production and management, as well as SEO and social media engagement best practices, for both Cabling Installation & Maintenance magazine and its website CablingInstall.com. He currently provides trade show, company, executive and field technology trend coverage for the ICT structured cabling, telecommunications networking, data center, IP physical security, and professional AV vertical market segments. Email: [email protected]