Report: Unforeseen challenges stymie outdoor small cell deployments

Infonetics Research has released its Small Cell and LTE Backhaul Strategies: Global Service Provider Survey, which provides insights into operator plans for small cell and macrocell backhaul deployments.

“2013 was supposed to be the year for greater deployments of outdoor small cells, but installations haven’t proceeded as quickly as operators expected," reveals Michael Howard, co-founder and principal analyst for carrier networks at Infonetics Research. Richard Webb, the firm's directing analyst for mobile backhaul and small cells, adds, “This is in line with our recent forecast in which we project that operators will spend $3.6 billion on outdoor small cell backhaul equipment over the five years from 2013 to 2017, down from earlier forecasts based on operator plans.”

According to the survey data, operators are finding that outdoor small cell deployments are more expensive than anticipated: more respondents now expect the 5-year TCO ratio of a small cell deployment to be 25% of a typical macrocell deployment, up from 10% in Infonetics' 2012 survey.

Related: Report sees 5-year, $5 billion opportunity in outdoor small cell backhaul

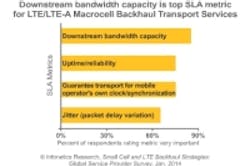

The small cell and LTE backhaul survey finds that downstream bandwidth capacity is a top service-level agreement (SLA) metric for backhaul services supporting LTE and LTE-Advanced (LTE-A). Further, 1/4 of operators surveyed indicated they will use software-defined networking (SDN) in outdoor small cell backhaul networks by 2016 or later. Additionally, while discerning a big opportunity for point-to-multipoint (P2MP) backhaul topology in dense urban areas, the survey finds only a few manufacturers shipping P2MP products today, including BluWan, Cambridge Broadband, and Intracom.

"It’s no picnic out there for operators," concludes Infonetics' Howard. "Costs are higher than anticipated, and many challenges remain difficult to solve, including siting, jurisdictional issues, unsettled local regulations, power availability, copper and fiber availability, small cell packaging with or without backhaul, just-coming-available technologies and products, and backhaul connections. Not to mention the coordination of small cells with WiFi or nearby macrocells over new types of backhaul that must support strict timing, sync, and latency requirements for LTE and LTE-Advanced in the future."

Learn more about the survey.

About the Author

Matt Vincent

Senior Editor

Matt Vincent is a B2B technology journalist, editor and content producer with over 15 years of experience, specializing in the full range of media content production and management, as well as SEO and social media engagement best practices, for both Cabling Installation & Maintenance magazine and its website CablingInstall.com. He currently provides trade show, company, executive and field technology trend coverage for the ICT structured cabling, telecommunications networking, data center, IP physical security, and professional AV vertical market segments. Email: [email protected]