Analyst: Mobile services driving global telecom, datacom markets

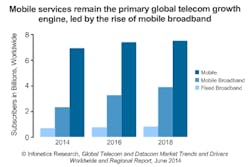

Infonetics Research has released its latest Global Telecom and Datacom Market Trends and Drivers report, which analyzes global and regional market trends and conditions. According to the analyst, the International Monetary Fund (IMF) anticipates the world economy will expand 3.6% in 2014 (+0.06 from 2013), amid recoveries in the UK and Germany, and slowing growth in Japan, Russia, Brazil, and South Africa. The report states that mobile service revenue remains the main telecom/datacom growth engine worldwide, led by the unabated rise of mobile broadband.

About the Author

Matt Vincent

Senior Editor

Matt Vincent is a B2B technology journalist, editor and content producer with over 15 years of experience, specializing in the full range of media content production and management, as well as SEO and social media engagement best practices, for both Cabling Installation & Maintenance magazine and its website CablingInstall.com. He currently provides trade show, company, executive and field technology trend coverage for the ICT structured cabling, telecommunications networking, data center, IP physical security, and professional AV vertical market segments. Email: [email protected]