Half a million 802.11ac Wave 2 access points shipped in Q3

In a recent quarterly tracking report covering wireless LAN (WLAN) equipment and WiFi phones, IHS Markit reported that WLAN equipment sales totaled $1.4 billion globally in the third quarter of 2016. That is a 6-percent sequential growth over the second quarter, due to a seasonal pickup in demand. It also represents an 8-percent year-over-year increase from the third quarter of 2015. From a volume standpoint, IHS Markit reported that access point shipments were up 21 percent year-over-year.

“A total of 6 million access points shipped in Q3 2016, including more than 500,000 802.11ac Wave 2 units,” the analyst firm said. “Wave 2 accounted for 10 percent of all units in Q3, nearly double Q2’s rate.”

IHS Markit continued, “Despite strong adoption of 802.11ac and Wave 2 products, average selling prices have not increased and are in fact down more than 10 percent year-over-year. Demand for WLAN is strong, but monetizing that demand has been a challenge for the last two years as organizations chose lower-cost approaches.”

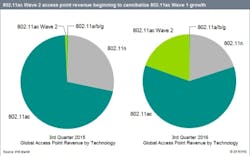

The graph on this page reflects that dynamic. As the firm explained, Wave 2 access points accounted for 10 percent of units shipped in Q3; but as the graph shows, the “Wave 2” slice of the pie for Q3 2016 represents approximately 20 percent of revenue.

The analyst firm asserted that despite the popularity of lower-cost access points, “The outlook for the WLAN market remains bright, as infrastructure investments over the long term will shift to WLAN equipment to support the rapid rise of wireless devices, both personal and for the Internet of Things, and also requirements for mobility.”

IHS Markit also reported the following about the global WLAN market.

- Asia-Pacific, the fastest-growing region for WLAN in 2015, continued to lead in 2016. Fiscal stimulus in China helped drive demand.

- In North America, the commencement of the FCC’s new E-Rate program helped to steady the market, but growth there remains relatively small.

- For Europe-Middle East-Africa (EMEA), Brexit is likely to cause lower growth in 2017, but a resurgence in 2018 will continue through 2020.

- Revenue leaders in Q3 were, in order: Cisco, HPE (Aruba), Brocade (Ruckus).

- Huawei and Ubiquiti led in year-over-year growth. IHS Markit characterized Huawei as a “major WLAN player, tripling revenue year-over-year” thanks to steady demand in China and its expansion into Europe.

- Portfolio updates propelled Ubiquiti to 53-percent YoY growth.