Study examines North American copper and fiber cabling market through 2018

IHS has produced its initial Network Cabling study, which examines the market for copper and fiber-optic cabling in North America over the time period 2013-2018. The report was authored by research analyst Sarah McElroy, who also recently published this “fact vs. fiction” article on the topic of Category 8 cabling.

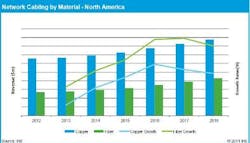

While IHS did not reveal any of the study’s numerical results, it did provide the chart seen below, which shows overall market size as well as growth lines for copper and fiber cabling. According to IHS, the study “features market size estimates across six strategic segmentations” and was developed “in consultation with top copper and fiber suppliers to the network cabling market in North America. Estimates and forecasts are based on actual sales data collected from leading suppliers, as well as more than 30 interviews with industry personnel.”

The company also said the study discusses market drivers including the growth of wireless implementation, data center consolidation, virtualization, data center infrastructure management (DCIM), and high-speed applications. “Granular analysis by product type and other segmentations are accompanies by substantive content on topics such as the shifting product mix and Category 8 cable, providing a broad range of information.”

IHS said the study also answers the following questions.

- What products are growing the fastest?

- How is the ratio of copper to fiber changing in each application (i.e. data center, LAN, factory/industrial)?

- What impact is data center consolidation having on the North American cabling market?

- What market share do the top suppliers hold?