Ethernet transceiver sales dip 18% in 2019, after nearly a decade of growth: Report

LightCounting says the market for Ethernet optical transceivers is expected to decline by 18% in 2019, which will be the steepest decline in the recorded history of this market.

As noted by the analyst, "The previous decline in 2009 was only 4%, and there is no reliable data on the decline during the telecom market crash of 2002-2003, but that decline was not very steep for Ethernet products since these were not widely used in the telecom applications yet."

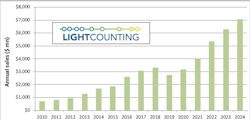

According to LightCounting's latest report, global sales of Ethernet optical transceivers increased by 16% CAGR in the period from 2004 to 2018, including a 5-year streak of 27% CAGR in 2012-2017. This accelerated growth was driven by deployments of optics in mega data centers.

Per LightCounting, "The growth streak was started by Google deploying 10GbE transceivers in 2007-2008 and gained scale in 2012-2017 with the adoption of 40GbE and 100GbE transceivers."

Despite the recent dip, the analysis suggests that this market segment will post a 22% CAGR in 2019-2024, after a reset in 2019, driven by sales of next-generation products and continuing demand for 100GbE optics, as shown in the figure above.

LightCounting's analysis maintains that several factors contributed to a slowdown in the market growth last year and a decline in 2019. These factors were as follows:

1. Transition to next-generation products takes longer than expected.

2. 100GbE prices reached new lows in Q1 2019 and reset expectations for the pricing of the next-generation products,

3. A slowdown in Cloud spending on optics deployed inside mega data centers.

"There is a lot of economic uncertainty related to the escalating trade war between China and the US," writes LightCounting. "The trade war has already impacted the economy in China and Chinese Cloud companies have lowered spending on high-speed optics as a result. More conservative infrastructure spending of US-based vendors aligns to the uncertain macro-economic situation," adds the analyst.

LightCounting’s new High-Speed Ethernet Optics report offers a comprehensive forecast with more than 50 product categories, including 10GbE, 25GbE, 40GbE, 50GbE, 100GbE, 200GbE, 2x200GbE and 400GbE transceivers, sorted by reach and form factors.

The report provides a summary of technical challenges faced by high-speed transceiver suppliers, including a review of the latest products and technologies introduced by leading suppliers. The research is based on confidential sales information and detailed analysis of publicly available data released by leading component and equipment manufacturers along with considerable input from industry experts.

More information on the report is available at: https://www.lightcounting.com/Ethernet.cfm.