IDC: Worldwide IT spending to decline by 2.7% in 2020 under COVID-19

A new IDC forecast says worldwide IT spending will decline 2.7% in constant currency terms in 2020 as COVID-19 impacts the global economy and forces organizations around the world to respond with contingency planning and spending cuts in the short term.

The analyst adds that, in line with previous economic recessions, IT spending on hardware, software, and IT services is likely to decline by more than real GDP overall, as commercial IT buyers and consumers implement rapid cuts to capital spending congruent with declining revenues, profits, market valuations, and employee headcounts.

"Overall IT spending will decline in 2020, despite increased demand and usage for some technologies and services by individual companies and consumers," comments Stephen Minton, program vice president in IDC's Customer Insights & Analysis group.

Minton adds, "Businesses in sectors of the economy that are hardest hit during the first half of the year will react by delaying some purchases and projects, and the lack of visibility related to medical factors will ensure that many organizations take an extremely cautious approach when it comes to budget contingency planning in the near term."

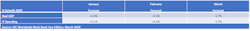

Note: IT Spending growth at constant currency.

IDC states that major spending declines this year are now expected in PCs, tablets, mobile phones, and peripherals, with overall spending on devices expected to decline by 8.8% in constant currency terms.

According to the analyst, "The PC market was already expected to decline on the back of a strong Windows-driven refresh cycle in 2019, but the COVID-19 crisis will significantly disrupt a smartphone market that was projected to post stronger returns this year as a result of 5G upgrades."

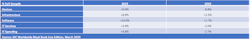

IDC projects that spending on server/storage and network hardware will also decline overall, despite strong demand for cloud services, as enterprise customers delay purchases during the initial rapid response phase of the current crisis.

According to IDC, "Total infrastructure spending (including cloud) will increase by 5.3%, but all of this growth will come from enterprise spending on infrastructure as a service (IaaS) and cloud provider spending on servers. Meanwhile, overall server/storage hardware spending will be down by 3.3% and enterprise network equipment spending will decline by 1.7%."

"Hardware spending in general is always identified for rapid spending cuts during any economic crisis, as a means for enterprises to quickly protect short-term profitability," observes Minton.

He continues, "In previous economic crashes, IT hardware has tended to overshoot the economic cycle on both the downside and in the recovery phase. That's because underlying demand drivers don't change overnight, but the timing of purchases is shifted and delayed, and this can now be done even more quickly than in the past. What's different now is that cloud is a bigger factor than it was in any previous global recession, and this should mean that overall spending is less volatile than in the last two major IT spending downturns."

Notes: IT Spending growth at constant currency. Infrastructure includes both hardware and cloud services.

IDC notes that IT services spending is expected to decline by 2% in 2020, with the worst declines in project-oriented services, as organizations hit the pause button on major new projects until business visibility improves. Spending on managed services and support services is also forecast to decline, in line with overall IT activities and hardware/software deployments.

The analyst adds that, "Software will post positive growth of just under 2% overall, largely due to cloud investments along with some resilient demand for specific categories, which will be a component of response measures or are integral to ongoing business operations."

"There will be pockets of opportunity for software and related services during the next six months, as organizations create response measures focused around increased remote work and collaboration," says IDC's Minton. "Organizations that are further along the digital transformation and cloud migration scales are likely to be best-positioned in terms of integrating these technologies into effective and agile response plans."

Including telecom and other spending, according to IDC, total ICT spending will decline by 1.6% to just under $4.1 trillion. This compares to overall ICT growth of 3.5% last year, when IT spending increased by almost 5%. Telecom spending will be less impacted overall, as demand for broadband remains extremely strong (in some cases, higher as a result of increased working from home and isolation measures, adds the analyst).

Note: IT Spending growth at constant currency.

The latest IT spending forecast from the IDC Worldwide Black Book will be the topic of an IDC webinar to be held April 7, 2020 at 11:00 am U.S. Eastern time. Stephen Minton will review the current outlook for technology markets in the context of the COVID-19 impact, alongside updated forecasts from the analyst's Worldwide Black Book: Live Edition and the new IDC COVID-19 Tech Index of leading market indicators and survey data.

Additional details and registration can be found at https://bit.ly/2X18Wuj.

The IDC Worldwide Black Book Live Edition is updated monthly with the latest IT spending forecasts for annual growth across 100 countries. It will continue to evolve and capture the escalating impact of the coronavirus on market expectations. To learn more about what to expect in the months ahead and what organizations should do in response to the markets' turmoil, visit https://www.idc.com/misc/covid19.